A Week In Chicago, IL, On A $170,000 Joint Income

September 04, 2020DMT Beauty#DMTBeautySpot #beauty

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a director of external relations who has a joint income of $170,000 and spends some of her money this week on Rockin’ Green athletic detergent.

Occupation: Director of External Relations

Industry: Higher Education

Age: 33

Location: Chicago, IL

Salary: $80,000

Husband’s Salary: $90,000 with potential bonus up to $13,000

Net Worth: We own a home worth approx. $450,000 that we recently purchased. We share one car that I was gifted from my parents, it’s ten years old at this point and worth about $10,000. My husband has a 401(k) with about $90,000 in it and I have a 403(b) with about $48,000 in it; the large difference is because my previous university didn’t match contributions; my current university matches by up to 9% contribution, but that is paused due to COVID-19. My husband has quite a bit of debt, see below.

Debt: I do not have debt; my husband has about $180,000 in loans from undergrad, grad, and a doctoral degree.

Paycheck Amount (Biweekly): $3,100 in normal times, $3,200 currently

Pronouns: She/her

Monthly Expenses

Mortgage: $2,150 ($236 of this is our HOA, which includes landscaping, snow removal, water, and a private garage parking spot. Our community is gated and this was an exceptionally good deal for our neighborhood, we were really lucky to see it and move quickly on it. We’ve lived here since March of 2020.

Husband’s Student Loans: $1,200 (we overpay these by $400/month)

ADT: $50

VCA Animal Care: $75

Hulu Live: $59

Gym: $10 per month (I use the university gym/pool and get a huge discount. This is paused during COVID-19 and usually comes directly out of my paycheck)

Work Parking: $85 (Paused since March 2020 and will not resume until 2021 at least. This normally comes directly from my paycheck.)

Community Garden Donation: $10

Animal Shelter Donation: $30

Food Bank Donation: $10

University Donation: $12 (taken out of my paycheck)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. Both of my parents have terminal degrees and did very well in their fields; there was no question that I would attend both college and graduate school. My parents paid for my undergraduate degree in full and I paid for graduate school with money I inherited from my grandfather when I was 22.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My father owns a finance company, so conversations about money were always happening in our home. I grew up in a town that is very affluent; ranging from upper middle class to truly 1%. We fell somewhere in between those two. My mother would occasionally compare us to my friends’ parents who were Fortune 500 executives or professional athletes, but my dad was always much more realistic that compared to most people, we were growing up extremely privileged and that we had a duty to give back, both financially and in volunteering. They both give extensively to arts, community, and education organizations and I try to increase donations every time I get a raise.

What was your first job and why did you get it?

I worked at the local country club during the summers starting when I was 16. I primarily taught children’s swim lessons and water safety courses, but I also was a lifeguard and did odd jobs as needed — selling ice cream or restocking vending machines. We were members of the club, so in theory my parents’ membership was just paying my salary, but they were really adamant about me having my own job and I enjoyed it. I worked there summers in high school and college. My parents’ big rule was that I was not allowed to work during the school year — academics and sports were my full focus. My first “real” job was after college in 2009 when I made $12 an hour as a public relations assistant.

Did you worry about money growing up?

No, and as an adult, I’m very grateful for that. When I was a kid, I grew up in a community where no one worried about money so I didn’t realize how normal that would have been. After I went to college, I tried to be very mindful that most people didn’t grow up like I did, so I tried (and still try) to not be an insufferable asshole and to quietly support my friends the best I could — picking up dinners or paying for a friend’s therapy appointments when her school insurance wouldn’t cover it. Now that things like GoFundMe exist, it’s gotten a lot easier to do that quietly.

Do you worry about money now?

No, but I try hard to keep my mouth shut about that. In reality, most of my friends as adults are also in the position to not worry about money; nearly all of my friends are as (or more) financially comfortable than I am. I will say that it’s something we don’t discuss or show off. I think TV makes it seems like “rich kids” are always like Gossip Girl or a Bravo show — in reality, we often just sit on each other’s patios and drink beer and eat pizza.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I think I became mostly financially independent when I got married six years ago. Even then, I still have money left from my inheritance, so I’m not sure I could truly call myself “independent” even now.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, when I was 22 my grandfather passed away. He lived an incredibly austere lifestyle, in a tiny house, driving a truck he bought in 1980, but he was also the sole heir to a very large company that liquidated post World War II. He invested that money in 1946 and never touched it. When he died in 2009, my father and his siblings all inherited close to $1 million each and my six cousins and I inherited residuals as trust funds that were about $100,000 each, with limits on how much we could withdraw from it each year. I’m appreciative of all of this, but I also wish he had spent more of it on himself and my grandmother while they were alive. I used that money to pay for graduate school, my first car, a study abroad program in Europe for six months, and my first apartment for several years. I recently withdrew $15,000 of it towards our home’s down payment and there is still about $15,000 left that I’m saving for our future child’s education and adoption fees since we plan to start the process in 2021.

Day One

8 a.m. — Up and at ’em and immediately dive into work.

4 p.m. — I have been working nonstop all day and usually would go for a post-work run to de-stress. However, it’s a million degrees out today, so my husband, L., and I decide to go for a long walk instead. We decide to explore a historic cemetery near our house. We stop at Starbucks on the way — I get my regular skinny vanilla latte and L. gets a refresher. We head over to the cemetery and walk around for over an hour. $8.32

5:30 p.m. — We’re hungry after our walk, so we stop at a burger restaurant near Wrigley Field. A lot of restaurants in this area have the same kind of food, but this one has a shaded patio and the food is actually really good. Their menu only has five things that are either burgers or chicken, so we both get a cheeseburger and glasses of water. We finish up and walk the half-mile home. Once home, I feed the dogs and take a quick shower. $24.97

6:30 p.m. — We pack up some snacks and walk over to our friend’s house. On the way, we stop at a bodega and buy a few White Claws as well. There are six of us in total and we all sit six feet apart on their patio. My friend is a doctor who is currently out on maternity leave, so we’re really careful to stay far apart. We’ve been doing this every few weeks since COVID began. We stay for a few hours, then walk the one mile home. $5.15

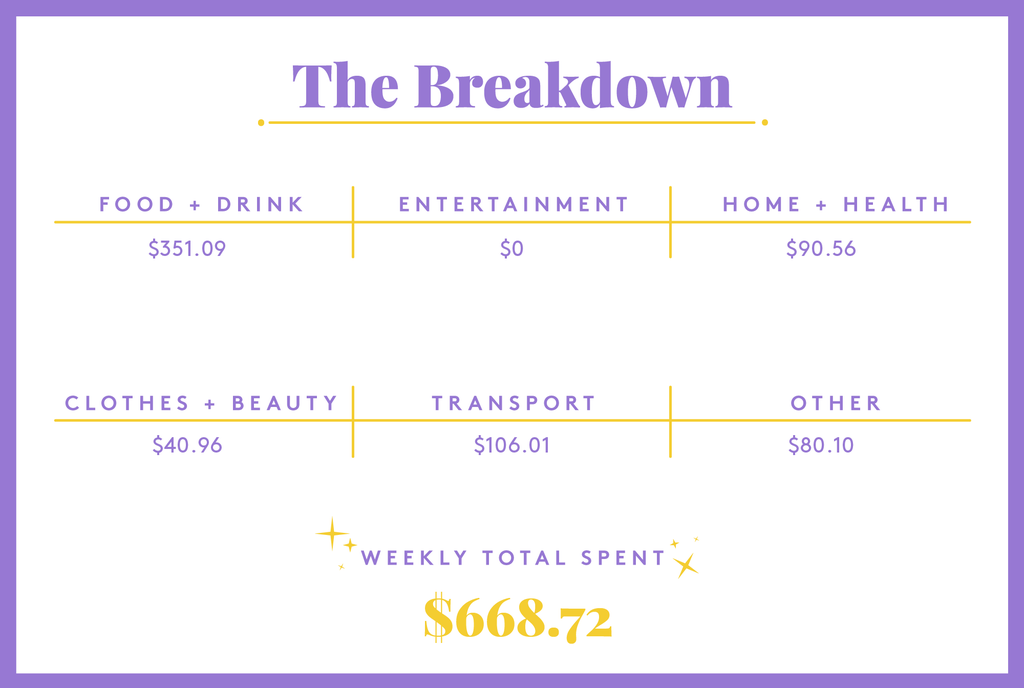

Daily Total: $38.44

Day Two

8 a.m. — I’m up and start work.

12 p.m. — Work has been rough lately — higher education is constantly in flux, deciding whether we’ll reopen all virtually or in some hybrid fashion. And because of all of this, our budgets have been decimated. In previous years, I would be planning a lot of fall events, but now all of them are either virtual or not happening at all. I field calls all day from concerned stakeholders and do the best I can to answer their questions. I understand everyone is stressed, but I’m just the messenger and the stress is adding up from everyone blaming the messenger. I jump on to Indifit and register myself and L. for our favorite outdoor yoga class in the park tonight. We head over to the yoga class at 5:30, it’s in a smaller neighborhood park that has free parking. $20.50

7 p.m. — After yoga, we drive over to our favorite Mexican restaurant. It was a deal I made with L. — he comes to yoga with me and I agree to tacos after class each week. I manage to find street parking a few blocks from the restaurant so I only have to pay $2 for parking instead of the restaurant’s garage which is $15. $2

7 p.m. — Happy hour at our favorite place is 6-8, so we share a plate of four mini tacos, two fish for me and two beef for L. from the happy hour menu. It also comes with a huge side of arroz con crema and elote. The chips and salsa are free and I have two skinny margaritas while L. has one Corona Light. It’s our waitress’ first day and she’s super nervous and messes up our order, but we tip 20% because she’s really nice and right now is such a tough time for the hospitality industry. $43.86

8:30 p.m. — We come home from dinner, walk the dogs, and put on reruns of Brooklyn Nine-Nine on Hulu. Outside of his regular job, L. is also a 50% partner in a small men’s grooming company, so he jumps on a call with his business partner while I browse Instagram. I see an ad for Rockin’ Green athletic detergent and decide to go for it; I work out nearly every day and if it’s as good as it says, my workout clothes could use a good deep cleaning. The sample is free but shipping is $5.95. $5.95

Daily Total: $72.31

Day Three

11 a.m. — Our monthly ADT bill comes in, I pay it immediately (in monthly expenses). We live in a safe neighborhood, but when we moved into our house it has a system from the early 1990s that connected to a bunch of non-operable smoke detectors and a broken alarm button. We had ADT come in and rip the old systems out and put in brand new smoke detectors and fire protection as well as linking us to the community security system. Our small community is a good mix of young families, couples, single people, and elderly people. A fifth of our monthly ADT bill goes to the general community security system like motion lighting, a secured entry and a secured garage, so I appreciate the sense of shared responsibility there. After paying, I make myself my usual lunch: Trader Joe’s chicken salad, water crackers, carrots, and a banana.

4:30 p.m. — After working nearly non-stop all day, I call it quits at 4:30. I head downstairs to feed our dogs and realize they’re both running low on food. I jump on to Chewy.com and reorder both of their food — our older dog eats prescription food so his is slightly more expensive. Afterward, I head out for a run in Lincoln Park. I’m lucky enough to grab a parking spot on a side street so I don’t have to pay. $42.91

6:30 p.m. — On my way home from my run, I stop at Trader Joe’s for regular groceries. It’s a lot to list, but we generally buy: tofu, chicken salad, hardboiled eggs, corn on the cob, a few bags of spinach, almonds, bananas, broccoli, veggie sausage, tortilla chips, peach salsa, salmon, potatoes, turkey burgers, and PB Light protein ice cream. When I get home, L. fires up the grill and cooks the turkey burgers and corn on the cob while I make a spinach salad. $106.91

9 p.m. — Our best couple friends text us a photo — they had a baby! It’s going to be at least two or three months before we can see him in person, but I jump on to the Neiman Marcus website and send him his first teddy bear as a gift from us. $29.63

Daily Total: $179.45

Day Four

12 p.m. — It’s finally Friday! My boss texts our team at 11:30 and lets us know we can take a half day today since we’ve all been working so much. I use the time to get my daily run in earlier than usual. I drive to Lincoln Park and street park, it’s $2.85. $2.85

1:15 p.m. — I finish my run — the city of Chicago requires masks if you’re working out on the lakefront trail or in city parks. I have one that I’ve been using for a few months and I notice today it is starting to get stretched out. I sit in the park for a few minutes and Google around for best running masks and see a recommendation of Athleta’s masks on Runner’s World’s site. I jump on to Athleta.com and find them on sale three for $20 and then check OldNavy.com for running tops on sale — I find one on clearance for $4.50 in my size. I have a Banana Republic Luxe credit card, so I get free shipping from both stores and order them on my card. Then I jump into my BR account and make a payment for the $25.31 right away so I don’t forget. $25.31

6 p.m. — After getting home, taking a shower, walking our dogs, and relaxing for a few hours, L. and I mask up and head out to dinner to meet two of our friends from our “quarantine circle.” We go to a local craft pizza place we’ve been wanting to try and see they serve Bang Bang Pie, a local bakery that everyone raves about. One of our friends is hard of hearing and ordering food is exceptionally hard for him when everyone has masks on and he can’t lip read. The waitress by chance knows sign language and it makes our ordering process so smooth. We sit outside (as the city requires) and share two large thin-crust pizzas, two salads, two pitchers of margaritas, and four enormous slices of pie. L. also has a few beers from the happy hour menu and the four of us split the bill 50/50. The total (with tip) for L. and me comes to $118.61. After wrapping up and tipping our waitress very, very well for being so accommodating, we close up and walk down the street to a local brewery. $118.61

9 p.m. — We get to the local brewery and there’s a bit of a wait — we stand outside for about 20 minutes and then our seats on the patio are open. All of Chicago’s bars have been ordered to close at 10, so we each get one drink in before they call last call at 9:30. We again split the bill 50/50 and our portion comes to $15.71. After that, the four of us head home — we all live on the same street, our friends are just a few blocks further. I’m grateful to live somewhere so walkable, with COVID I don’t know that I’d feel totally comfortable taking an Uber or the train right now. $15.71

Daily Total: $162.48

Day Five

8:30 a.m. — I wake up in time for my bi-weekly Saturday yoga class. The class is technically free, but donations are accepted and it’s always such a good class. I would pay significantly more if I went to a regular yoga studio, so I donate $5 at the end of class. $5

10:30 a.m. — After yoga, I make my usual Saturday breakfast of homemade crepes with spinach and goat cheese, then take a shower and leash up our older dog for a walk. I pre-order my regular skinny vanilla latte from our local Starbucks. I text when I’m right outside and the barista walks to the window and slides my drink out so I don’t have to leave my dog alone outside (which terrifies me). We walk around the neighborhood a bit while I drink my coffee and then settle down on a bench to call my mom. I spend a few hours cleaning up and doing laundry and putzing around this afternoon. $4.45

2 p.m. — Standing in our small yard, I realize several of our plants were washed away in the recent storm. We originally purchased our plants at Home Depot because they sent us so many discount cards when we bought our house, but none of the flowers have done all that well. I jump in the car and drive over to Farmer’s Market Garden Center — it’s a specialty greenhouse but is actually cheaper than Home Depot and their staff is amazing. I mask up and spend about an hour learning about plants and gardening in Chicago weather from a woman who works there and she helps me pick out a bunch of plants that she thinks would do well in our shady yard. When I get to the register, the total comes to $85, way more than I anticipated, so she helps me put a bunch of plants back and find less expensive ones I like just as much. I end up with two large Calamintha Montrose plants that smell amazing and attract butterflies and a bag of potting soil. $23.50

4:30 p.m. — On the way home, I stop at the post office and mail a birthday gift to my friends’ son. He recently started swim lessons, so I bought him goggles and a children’s kickboard. It’s such a weird shape that I have to get a flat envelope that is enormous, but inexpensive. I pack it up and my favorite mail lady is there today. The last time I was in she commented on my Bath & Body Works hand sanitizer that looks like whipped cream. Today she tells me she bought a bunch of it for her teenage daughter to get her to use more sanitizer and she loves it. I make a mental note to buy a few extra for her before the next time I come in. $7.56

5 p.m. — I stop at home and change into running clothes, then head to the park for a short-ish run. I do 20 easy minutes and get stuck street parking, so I pay the $2 to park. After my run, I rest on a bench and read an email from a local woodworker. We bought an antique dining table when we bought our house a few months ago, but I haven’t been able to find any benches I really like that go with it. Last week, I reached out to a woodworking studio in our neighborhood. He quotes me $700 for two dining benches and asks if I’d like to come in later this week to pick out styles and stains. We schedule it for Thursday at 4 and then I head home. $2

6:30 p.m. — We have zero plans tonight, but I got an email to my work account about having Jimmy John’s rewards that expire tomorrow. Back when higher ed budgets were still doing great, I used to order Jimmy John’s for student groups all the time, so I’m not surprised I have so many rewards. L. orders a regular turkey 8″ sandwich and I get a mini veggie sandwich. We share a bag of chips. Our food is free but we pay delivery and tip, $9 for dinner for two is pretty good. L. jumps online to do some more work for his small business and I watch reruns of Dateline like the 80-year-old woman I am. $9

Daily Total: $51.51

Day Six

8 a.m. — I get up early and get my Sunday long run in. As usual, I have to pay for street parking, this time for two hours this time instead of my usual one. In every other city I lived in, there would be “off” hours when parking was free, but Chicago parking charges you at all times. At least they’re consistent. $4

10 a.m. — As I’m running, I passed a man selling elotes near the park. I don’t really want to eat this early in the day, but I’ve passed this man a few other times and he’s always very nice and I know that those vendors are struggling right now, so I buy a bottle of water for $1 but give him $5 for it. I have water in the car, but I think vendors and local businesses can use help when I have a chance to give it. $5

11:30 a.m. — Our car is due for an oil change and L. reminds me he has an appointment this afternoon to take it in. I’ve owned this car outright for several years, so I try to take really good care of it. I don’t plan on trading it in while it’s still in any sort of passable shape, so I’m less concerned with taking it to a fancy dealership if the guy down the street can do a good job. In our neighborhood, it’s an old man with his own repair shop; he changes the oil, refills all of the fluids, and rotates the tires for $70. We walk around the park nearby while he works, it’s Sunday so they’re not busy at all and he’s done quickly. $70.15

2 p.m. — After the auto shop, we stop for gas and a car wash — it’s been a million degrees out lately and it feels like the dirt is actually baking on to the car. I’m lucky that my car gets exceptionally good gas mileage, but we also haven’t driven very much since March. In normal times, I would commute 20-30 minutes each way and fill up for gas every 10 days or so, now I fill up maybe once a month. $23.01

7 p.m. — Back at home, L. cooks up some chicken and apple sausage on the grill as well as the rest of the corn on the cob. I make another spinach salad. Afterward, we mask up and walk over to a local ice cream spot and each get one scoop of ice cream, we walk down side streets while we eat to avoid passing people too closely. $9.11

Daily Total: $111.27

Day Seven

12 p.m. — I have been working non-stop since 8:30, but I take a break for my usual weekday lunch and order a few things from Target for pickup. We need shower cleaner, toothpaste, dish detergent, and a few things that Trader Joe’s was sold out of last week, like parmesan cheese and lemon juice. I place the order for a two-hour pickup and L. runs out this afternoon to pick it up. $35.61

2 p.m. — I take a break and check my ThredUp account. They’ve been really backed up, so my order that I sold back in February has finally finished processing. I have $22.53 in store credit, so I buy a J.crew sundress. It comes to $38.18, but with store credit my total comes to $15.65. $15.65

4:45 p.m. — This Monday has been insane. The university’s plan for reopening has changed (again,) so now we’re trying to coordinate communications about that. A lot of our former communal areas are being turned into giant socially-distanced classrooms and every day there is another new complication we haven’t thought of. Finally, at 4:45 I can’t focus anymore so I head to the park for my usual run and street park ($2). Afterward, I come home and cook dinner — baked salmon with potatoes and veggies, it’s a super easy recipe. I open a Caesar salad kit and put 1/3 of it into a mason jar and wrap up the extra salmon. I’ll heat that up tomorrow and put it on the salad for lunch. $2

Daily Total: $53.26

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Portland, OR, On A $77,250 Salary

A Week In Los Angeles, CA, On A $42,000 Salary

A Week In Salt Lake City On A $1,600,000 Income

DMTBeautySpot

via https://www.DMTBeautySpot.com

Refinery29, Khareem Sudlow

0 comments