A Week In Coastal Massachusetts On A $117,000 Joint Income

September 25, 2020BruceDayne#DMTBeautySpot #beauty

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

It’s fair to say, 2020 hasn’t been a normal year. Whether you’ve been stuck working from home for months, were laid off, or are an essential worker, COVID has changed the way we spend money. Whether it was a sweatpant splurge or the security deposit on a new apartment, fill out this form to tell us about your biggest pandemic purchase and how COVID has changed your relationship with money.

Today: a fine gardener who makes $63,000 per year and spends some of her money this week on a linen shirt.

Occupation: Fine Gardener

Industry: Landscaping

Age: 28

Location: Coastal Massachusetts

My Income: $63,000 (This is a total of all my income sources, which include my main job, unemployment, and personal work. I get paid hourly so my weekly paychecks vary widely based on the time of year and workload. I get laid off every year for a couple of months during winter when the available work comes to an end at which point I collect unemployment, which is calculated by the state based on what I made that year working. This seasonal unemployment situation is common for “unskilled” labor in seasonal/resort towns like the one I live in and because of this, the company I work for pays much higher unemployment insurance. Then on top of all that, I also do my own work on the side. This year, the breakdown looks like $44,000 from my company, $13,000 from unemployment, and $6,000 from personal work.)

Husband’s Salary: $54,000 (plus a $2,000 food stipend)

Net Worth: $285,000 (Breakdown: We bought land three years ago that we mortgaged, currently worth $450,000. We still owe $275,000 on it. We have a car and a truck, worth about $25,000 total. We have $50,000 in the bank, $10,000 in stocks, and $10,000 in maturing bonds. We also have about $15,000 in various retirement-related accounts. My husband and I have our own savings accounts that our paychecks go into and that we pay bills from. We have a joint account that we transfer money to for construction-related expenses (ie, well drilling) and our eventual loan downpayment. We don’t keep track of who pays for what, but it’s pretty evenly split. All of our income is shared equally.)

Debt: $275,000 (mortgage)

Paycheck Amount (Weekly): $1,000-$2,000

Pronouns: She/her

Monthly Expenses

Rent: $1,350 for a two-bedroom my husband and I rent

Mortgage: $1,670 for our land loan (though we’ve always paid $2,000)

Cell Phones: $160 for husband and I (unlimited data, still paying off my iPhone X)

Property Tax: $200

Electricity/Propane: $150 (dehumidifier in the basement kills our bill)

Patreon: $5

Health Insurance: ~$600, deducted from husband’s paycheck

Car Insurance: $70

IRA: 3% deduction for both of us (our employers match 2%)

Internet: we don’t have internet/TV access at our house so have no related expenses

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Whether I would attend college was never a question. It was 100% expected of me, especially because I was so good at school. Though my mom went to college, she ended up as a house cleaner, and there was always an unspoken shame surrounding her job and an expectation that my sister and I would have “real careers.” Ironically (or perhaps not?), I ended up in a very similar line of work that doesn’t require a degree (sister too), but I love my work, and my bachelor’s in horticulture has been invaluable to what I do. My tuition was covered by scholarships. My housing and food, etc., while I was in school was paid for with my summer work money propped up by my father’s social security I inherited when I turned 18 (he died when I was 10, and his SS went to my sister and me).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Though I don’t remember specific lessons, I was essentially taught by my mother through observing her actions and very loud opinions to always save my money. My mother constantly talked (usually negatively) about other people’s/families’ spending choices and she viewed everything through the lens of monetary value and financial consequences. Her tight grip on money and careful spending was a constant stressor and presence. I learned from a young age that asking for anything that required money (material objects, opportunities, etc) was a huge trigger for my mother so I never asked for any money and learned how to make it myself. I picked up frugality (and major financial stress) from a young age. I constantly check myself in judging other people’s financial choices and placing value on things in monetary terms alone.

What was your first job and why did you get it?

I started babysitting around 12 to have some cash and because as soon as I could be trusted alone (and apparently with other children), I was left to my own devices and needed something to do. I did that, as well as working as an under the table counselor-in-training until I got my first taxed job at 14 at a mini-golf place. I’ve worked ever since.

Did you worry about money growing up?

Yes, I always worried about money. Modeling my behavior after my mother from a pretty young age, I didn’t like spending money because I never knew if I’d need it in the future. I felt guilty for the normal everyday expenses I burdened her with (clothing, food) because my mother was very open about her money-related stress. It’s not like there wasn’t enough money to feed or house us, and my mom owned (mortgaged) the home we lived in, but the stress of never having quite enough was always there.

Do you worry about money now?

All the time. I am constantly doing math in my head related to our finances and always save as much as I can. My husband and I don’t go out to dinner or bars, we have never been on vacation in the ten years we’ve been together, and we don’t buy much more than we need. If we make a larger purchase, it’s going to be something that we’ll have forever. I price check smaller purchases we make across multiple websites and buy most essentials in bulk to save money in the long run, but it’s also probably another scarcity mindset coping mechanism. I’ve been avoiding Amazon, and it’s killing me knowing we are purposely spending slightly more at other places. But being so frugal (as well inheriting a sizable sum of money) has led to being able to afford to buy land (mortgaged) that we will soon build on. Building and owning a house has always been our ultimate goal — we both have hard nesting and homebody tendencies. Even so, parting with the money we’ll be putting down for the construction loan, not knowing what our future holds, is terrifying. While at the moment we are in a really great financial place and are about to embark on the super exciting major milestone of building our forever home, I’m terrified by the idea that we are in professions without a whole lot of upward movement and our income won’t keep up with inflation. Finances are the scariest unknown when I think of the future.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself as soon as I turned 18. I lived in my mother’s house until I went to college (a few months later) but never moved back in and was responsible for almost all my own bills and expenses (the only exception being my cell phone; I stayed on the family phone plan until I was 22 when my then-boyfriend and I upgraded to iPhones and got our own plan). My husband and I have a pretty hefty safety net in our own savings, but in the next few months, we’ll be putting it all down for our construction loan. By some miracle, we are both considered essential services (though my job certainly isn’t) and besides a brief local work moratorium for me, we’ve kept our jobs through COVID times and will likely be able to if things get shut down again.

Do you or have you ever received passive or inherited income? If yes, please explain.

When I turned 18, I started receiving annual annuity payments (for five years) from my father’s social security (he died when I was 10). It totaled about $75,000. I also received $20,000 from a distant relative who died a few years ago. The majority of the inherited money went towards the downpayment of $108,000 on our land three years ago.

Day One

5 a.m. — We both wake up. My husband, R., is out the door by 5:20 (life of a farmer). I switch on NPR and take my shot of iron before starting the laborious process of making coffee with my Chemex. I harvest some kale from the garden and make a smoothie — I have been drinking the same yogurt-blueberry-kale smoothie every day for years — and pack a salad for lunch from veggies my husband grew. He’s the veggie manager at a bougie farm that also produces bread, milk, meat, and eggs so we eat well and save a lot on our grocery bills. Out the door at 6 to get my work truck from the shop.

7 a.m. — As I pass my road to head to the job site in my work truck, I realize I forgot about my yogurt incubating in the closet. I run home real quick to take it out, leaving it on the table and hoping my husband comes home at some point to put it away after it’s cooled. I feel bad giving my dog the false alarm of coming home so I slip him a carrot. He’s crazy for veg so definitely forgives me.

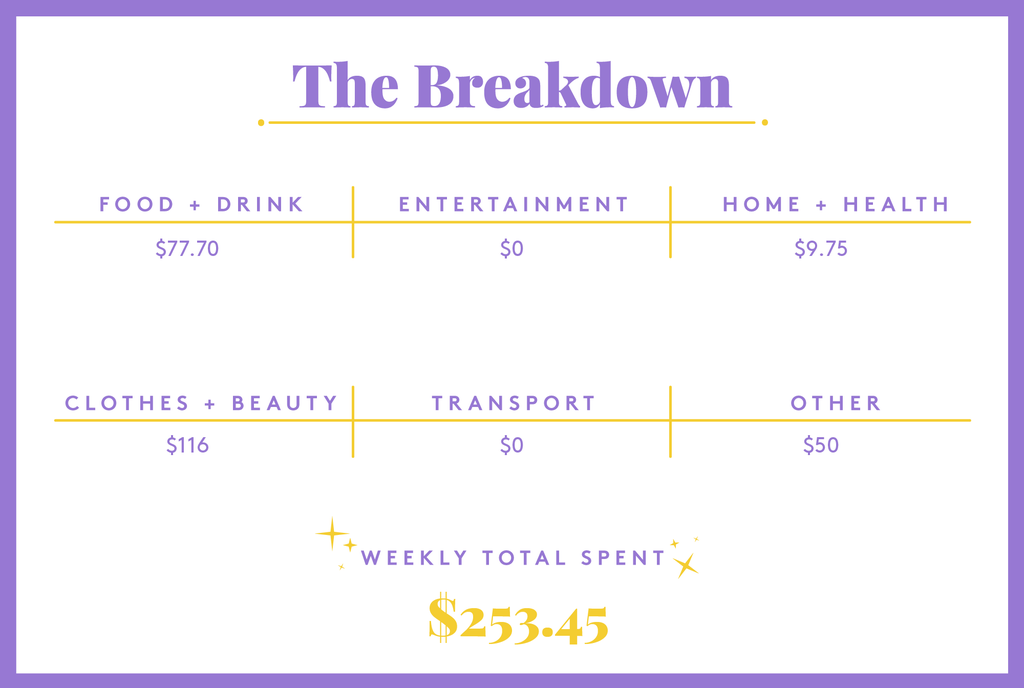

10 a.m. — I take a quick break from work to hit order on a shopping cart I’ve been narrowing down for a couple of weeks. I get three cotton shirts for myself and two linen button-downs that my husband and I will share for work. We both hate sunscreen so we wear linen long sleeves to protect our arms and shoulders. These ones were on sale so the pain of covering something so luxurious in dirt won’t hurt quite so badly. $116

3 p.m. — Done with work, drop off the truck. As I pull in the driveway, my husband is heading back out. He had a late lunch at home and took a nap because his morning greenhouse work gave him a headache. I eat my salad, tidy the house, and do some gardening.

7 p.m. — R. comes home and makes pizza with a leftover dough in the fridge. Pesto-broccoli-shiitake-pepperoni, my favorite! I have a horrible headache after dinner (didn’t drink enough water today) and lay on the couch cuddling one of the cats and reading. R. cleans the bathroom unprompted like the amazing feminist he doesn’t even realize he is then we go to bed around 10.

Daily Total: $116

Day Two

5 a.m. — Up and making coffee and breakfast. Before I leave at 6:15, I promise our dog that he’ll get a walk this evening. Normally, he gets a walk before work but he’s getting old and in the summer, he doesn’t enjoy it so we wait until it cools down.

12 p.m. — Graham sticks and carrots for lunch while I drive between job sites. Constantly reminding myself to chug water all day.

5 p.m. — Home from work, R. is close behind me. I start poaching chicken for dinner, cook beets for future salads, do the dishes from this morning, and tidy up a bit. We eat chicken quesadillas with some flour tortillas I made in the last couple weeks and homemade enchilada sauce. The dog gets the beet skins and a bit of chicken water added to his dinner while the cats look on with jealousy. If they got chicken stock, they’d definitely puke.

7:30 p.m. — We walk the dog together, as promised. R. does the dishes and makes a batch of mayo while I knit on the couch. We have homemade ice cream for dessert and are in bed at 9. I try to read my library book, Homegoing by Yaa Gyasi, but I’m asleep after a couple of pages.

Daily Total: $0

Day Three

5 a.m. — Awake! Iron, coffee, smoothie, kiss R. goodbye. I harvest celery and onion from the garden for tuna salad, then make a wrap with greens, cheddar cheese, tortillas, and scallion salsa I made over the weekend. The recipe is from Six Seasons by Joshua McFadden, which is my go-to for quick veggie meal boosters.

6:30 a.m. — I get to work and I’m surprised to actually see another person at the shop when I get there! With COVID and the hot days, I’ve been going in early, the normal start time is 8.

12 p.m. — I eat my wrap and Google pictures of murder hornets. My coworker and I are pretty sure we saw one but it was probably a European hornet (still giant!).

5:30 p.m. — Home from work and I am beat. R. came home mid-day and did dishes, cleaned the litter box, etc, so I feel good hitting the couch. I have a hard time relaxing if our house is a mess, and though my husband would barely clean or tidy if he was on his own, he keeps up with it for my sake. I do the billing for my personal gardening clients for the previous month. I work for a company during the week and have my own clients for weekends. Thankfully, by this point in the summer, the maintenance slows and it’s every other weekend.

8 p.m. — R. is at a friend’s, so I’m on my own for dinner. I have a salad, topped with the anchovy-lemon dressing from Samin Nosrat’s book Salt Fat Acid Heat. It’s crazy good!! Bed at 9:30 after a little bit of reading.

Daily Total: $0

Day Four

5 a.m. — Harder to get up this morning, as it tends to be towards the end of the week. But the alarm clock is on R.’s side of the bed (we have a no phone in the bedroom rule) so snooze isn’t an option! I do my normal morning routine and soak beans for dinner. I also boil my cup in case I get my period today.

6:30 a.m. — Do a couple of internet things at the shop before I leave (no internet at my own house and the cell service is horrendous). Email out my bills and donate $50 to a Lebanon-based animal rescue and recovery organization. $50

12 p.m. — Tuna wrap for lunch again, carrots too. I pocket some Gin Gins for afternoon snacking. I’ve been hooked on them for years (only when I work though) and always keep a few boxes on hand. Must be a blood sugar thing.

3 p.m. — Munch on some stale graham crackers I keep in my work truck for befriending wary dogs — a must when my daily job is going to people’s homes unannounced.

7 p.m. — I eat cooked beans straight from the strainer with my hands for dinner. Then I take the pup for a walk, beer in hand. I have some cheese and crackers when we got back, then break a glass — my fourth in the last week! I celebrate my clumsiness with the last of the ice cream. Get in bed around 9 and try to read, but who am I kidding…

Daily Total: $50

Day Five

5 a.m. — Finally Friday! I do my morning routine and start some pizza dough. The flour jar is out so I fill it from the 50-pound bag in the basement. We’ve been buying it this way for years so we were ready for the COVID lockdown!

10 a.m. — There she is! Luckily, I happen to be working at a property with bathroom access the day I get my period. Most of the properties I work at don’t have bathrooms offered to use, and due to COVID, all the public bathrooms are closed. I snack on carrots and eye the dark clouds, hoping for rain. It’s been months since we’ve had a good rain.

5 p.m. — I get in the door and immediately take off my shorts, as one does, only to find that I have bled through my cup, through my underwear, and through my shorts! Bahhhhhh this has never happened to me before. I reassure myself that maybe the long shirt I was wearing covered my butt. My husband tells me probably no one could even see that angle of my butt because I’m so short. Between that, the 44 deer tick larvae I pull off my body with R.’s help (a personal record), and the mismanaged and frustrating job site, it has been a DAY. I am SO HAPPY it’s Friday.

7 p.m. — I make some pesto with basil and parsley from the garden to put on our pizza. Pizza is a weekly Friday tradition that my husband’s family has had forever and we take it VERY seriously. After pizza and beers, we go on a walk then do some couch-scrolling. R. made a new batch of ice cream yesterday (mint chocolate chip, my FAVORITE!) so I have a bowl before bed.

Daily Total: $0

Day Six

6 a.m. — Manage to just barely sleep until 6. I kept waking up throughout the night. I always sleep horribly on the first day of my period. At least I get to drink my coffee sitting down this morning.

10 a.m. — I spend the morning in my garden. I have a couple of slices of buttered toast from one of the loaves R. brought back from the farm yesterday. Though this is my off weekend from personal work, I head out to do some watering since it’s been so dry. I stop by the hardware store to get some braces for a cabinet I recently refinished and windshield washer fluid. $9.75

1:30 p.m. — I make croutons from bread and have a salad. My mom stops by for a bit to word vomit and watch me spill my salad all over myself. I text R. to bring home carrots and milk from the farm.

7 p.m. — I spend the rest of the afternoon doing really exciting things like laundry, dishes, and unsuccessfully attempting to nap. I have an appetizer of ice cream for dinner (I really love ice cream). We have pizza for dinner again so we wouldn’t have to think about what to make and snuggle on the couch. Bed by 9 again….have I mentioned just how cool we are?

Daily Total: $9.75

Day Seven

6 a.m. — I try to sleep in and almost trick myself into falling asleep again but it’s not working. Listen to the white noise machine and fan until 7 then get up. R. is taking the day off! We have tons of shit around the house to do though…ugh our Sunday is already over and it’s barely started.

1 p.m. — We bring the kayaks down to the landing on our road and go for a paddle. I take a beer and R. takes a joint. We stop on a sand bar and eat our tuna wraps and watch the birds. It’s super windy so we don’t go as far as we normally would.

5 p.m. — Making yogurt. It takes so damn long but it’s so damn good and the savings are huge if we make it ourselves with the free milk we get. I set it to incubates in a cooler with hot water bottles in the closet overnight.

7 p.m. — Hot cheesy chicken sandwiches for dinner with onions, garlic, pesto, and peppers. No matter how hot it is outside, I’m always in the mood for hot cheese. After dinner, I order us some bulk snacky stuff (chocolate covered graham crackers, peanuts, dried mango, etc) from Nuts.com. I pick the last of the chicken off the bone and leave it on a plate, knowing full well that when we leave to walk the dog, the cats will jump on the table and eat the tiny bit of scraps. Then, of course, ice cream for dessert. Bed by 9. I barely manage a few pages. There’s no way I’m going to finish this book by the time it’s due on Wednesday. $77.70

Daily Total: $77.70

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

It’s time to wake up. On Global Day of Climate Action, VICE Media Group is solely telling stories about our current climate crisis. Click here to meet young climate leaders from around the globe and learn how you can take action.

Like what you see? How about some more R29 goodness, right here?

A Week In Maryland On A $121,000 Salary

A Week In Los Angeles, CA, On $15.50 An Hour

A Week In Berkeley, CA, On A $169,000 Joint Income

DMTBeautySpot

via https://www.DMTBeautySpot.com

Refinery29, Khareem Sudlow

0 comments