#DMTBeautySpot #beauty

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a behavioral health aide who makes $65,900 per year and spends some of her money this week on a microwavable gel eye mask.

Editor’s Note: This is a follow-up diary for the January 2018 Money Diary entitled “A Week In Anchorage, Alaska, On A $53,000 Salary.” You’ll want to read that first, here.

Trigger Warning: This Money Diary mentions an eating disorder.

Occupation: Behavioral Health Aide

Industry: Social Services

Age: 31

Location: Anchorage, AK

Salary: $65,900

Net Worth: $91,275.72 in savings, assets (car), and 401(k).

Debt: $0

Paycheck Amount (2x/month): $1,650 f/t, $200 p/t, $150 side hustles

Pronouns: She/her

Monthly Expenses

Rent: $500 ($1,500 duplex split three ways)

Utilities/Internet: ~$100 (we split utilities and internet equally)

Student Loan Payments: $0 (paid off!)

401(k): $186 (taken out of my paycheck, total is about $34,000)

Medical & Dental: $84.50 (taken out of paycheck)

Gym Membership: $21

Car Insurance: $80.53

Car Payment: $0 (paid off!)

Streaming Services: $43.97 (YouTube Red, Netflix, Spotify, Patreon. I share with like five people, and friends share their Disney+ and Hulu+ with me)

Cell Phone: $50 prepaid plan

Travel Savings: $800-$1,000 (I’ve been saving since May 2019, when I got completely out of debt. My current savings amount is $44,121.52, or 126.06% of the $35,000 I want to have saved for my yearlong trip which was supposed to start in June 2020. When I was working two jobs, I was adding $1,500-$2,500 a month.)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely! My mom barely got her GED so it was always of the utmost importance to her for me to get a Bachelor’s in… something. When I was in high school, it was taught like a religion that what your degree was in didn’t matter. If you had a Bachelor’s, you were guaranteed upward mobility. So I did what a lot of us did — I took out tens of thousands of dollars in student loans with literally no understanding of what that meant. None of it felt real and I felt promised that I would have the resources to handle the debt after school. I worked part-time jobs through college but it was pocket change compared to the tuition and living expenses that were largely covered by loans and grants.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I was raised by my mom who had a very laissez-faire approach to money. As a small business owner, money was sporadic and unpredictable, and she would tell me “there will always be debt, so enjoy your money while you can.” This mentality meant we were periodically homeless, often bouncing around and staying wherever we could. Money was not “real” and financial stability was, uh, not a thing. She did the best she could and I have the absolute utmost respect for single parents, but her lack of awareness or education about money meant that we often didn’t know where our next meal would come from (or somedays, if it would come at all), which also contributed to my toxic and insecure relationship with food.

What was your first job and why did you get it?

I started working two jobs at 16. I worked 20 hours a week editing my college newspaper (I was attending community college as part of a program offered by my state while concurrently attending high school) and about 15 hours at a clothing store in the mall. Ironically, I got in trouble at the clothing store because it was a higher-end boutique and I was wearing Wal-Mart clothing, but the feeling of knowing where and when I would get money was intoxicating. I’ve had at least two jobs for most of my life ever since.

Did you worry about money growing up?

Oh my god, constantly. One of my very first memories was of being evicted from the room we rented and moving into the car. This happened a lot and my mom always tried to make a “camping adventure” out of it but I knew what was going on. Seeing not only our horrific financial situation but also my mom’s incredibly irresponsible spending habits was super formative and one of the reasons I’m so weird and uptight about money now.

Do you worry about money now?

I worry about everything, but I’ve put enough of a buffer between myself and destitution over the course of my twenties that my worries are less intense but still there. I used to have recurring nightmares about becoming homeless again, but getting out of debt and having a decent amount in savings keeps the fear at bay. Plus my car. You’re never truly homeless when you have a car.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself at 16, though I was still living with my grandparents at the time. Making my own money and the freedom that came with that really demystified the idea of money for me. As a child, money felt very magical: some people had it and some people didn’t (we were the ones that didn’t). Making my own money helped me to realize that no, actually, it wasn’t some unattainable thing. It would be many, many years before I would claw myself out of debt and develop good financial habits, as most of my twenties were truly spent undoing the damage of childhood poverty and the poverty mindset. A lot of people don’t realize that “growing up poor” means that not only are you starting from zero (or starting your adult life with debt), you are actively having to undo a lot of early problems. For example, I had my first tooth pulled at 19 because I couldn’t afford to fix it and never went to the dentist or doctor as a child. Things like that.

Do you or have you ever received passive or inherited income? If yes, please explain.

I did inherit $10,000 when I was 21 after a relative passed away. I was doing a year of service through AmeriCorps at the time after college making $800 a month for 40+ hours a week working at a nonprofit, and that $10,000 changed my life. Not only did it give me the safety net I needed to finally stop living paycheck to paycheck, it completely shifted my mindset from always feeling like I was seconds away from destitution to finally being able to breathe and realizing that saving is actually possible.

Life Update Since My Last Diary

About two years ago, I did a Money Diary. So much in my life has changed since. My dog passed away (which was completely devastating), I changed careers, I got both into and out of a serious two-year relationship (with one of the guys from the first diary!), and decided in Summer 2018 to take my debt seriously. I still had about $16,000 in various debts and wanted to pay it off once and for all so I could focus on a major life goal: saving up $35,000 and traveling for a year (or possibly two) through the U.S., Europe, and Asia. I was supposed to start traveling in June 2020 and I hit my savings goal prior to that, but then COVID happened so I pushed my start date back indefinitely. I was also laid off from my part-time job until recently but they brought me back with (drastically) reduced hours.

My pup’s passing was a major catalyst for me. The pain of her loss made me decide I needed to do something major to shake myself out of the sadness and monotony I felt with my life. So, I reduced my lifestyle and spending, sold as much of my stuff as I could, started working two jobs, and eliminated almost all wasteful spending. My first Money Diary gave me some shocking insight into how I was spending recklessly and also made me realize my toxic and unhealthy relationship with food. I took the feedback from the diary and started looking into my eating disorder (I had no idea I had an eating disorder before my Money Diary but that’s EXACTLY what I have), and I made the decision to get weight loss surgery, which I got three weeks prior to this diary. I also met a new guy online and will be relocating overseas to live with him in a couple of months, after I have completely healed from surgery.

Day One

12 a.m. — I get to work and get most of my tasks done right away. I work nights at an adult treatment center, which basically means crisis management, ensuring patient safety, and being available for any incidents that arise during the night shift. Usually, the patients are asleep but my shift is there to make sure they are safe and accounted for and to be available should they need any support or medication if they wake up.

12:30 a.m. — I check my professional and personal email and see that I got feedback from a freelance editor I’ve been working with on one of my articles. She said she “loved” it, which feels good. I make the edits and send it back.

2:30 a.m. — It’s a quiet night so I spend time on my personal administrative tasks between work tasks. I try to stay off my computer as much as possible when I’m not at work, and there’s something satisfying about doing tedious personal shit while on the clock. Eventually, I eat and log my lunch (turkey lunch meat and swiss roll-ups with mustard) while watching the final season of The Good Place. I just got back on solid food after three weeks on a post-op liquid diet (from weight loss surgery) and I’m on a “soft food” diet that prioritizes protein for the next three months.

4 a.m. — I text with my long-distance partner, C., during his lunch break. He is a schoolteacher and we happen to have the same work schedule due to the fact that he lives across the world. 30 minutes after I finish eating I can finally drink water and the coffee I got for myself before work. Waiting to drink fluids after eating is one aspect of the surgery I didn’t expect and I do not like it! I listen to 90 Day Bae, one of several 90 Day Fiancé podcasts I listen to religiously because ya girl loves trash TV and feels no shame.

8 a.m. — I chat with my coworker a bit before clocking out and heading home. I video chat with C. while I get ready for bed. I fall asleep around 9 a.m. to the soothing sounds of The Office. Our ancestors used nature sounds to fall asleep; I am lulled into unconsciousness by Michael Scott shouting at Dwight.

3 p.m. — I wake up earlier than expected and C. video calls again. We end up talking for almost three hours. Life will be easier when we’re in the same country but for now, this will do until I move there in January. I’m tempted to fall back asleep because anything less than eight hours is a nap, but I know I won’t be able to so I get up, shower, put on my exercise clothes, make a protein shake and head out the door.

6:15 p.m. — While waiting in an outrageously long Starbucks drive-thru line, I check the AllTrails app for a good place to walk. One thing I hate about walking (and exercise in general) is the monotony of it, so I have a soft goal to eventually walk all the trails in my city. I find one that isn’t too far and plug the trailhead into Google Maps. I pay for my grande iced americano and head that direction. $3.65

7 p.m. — It takes forever to find the actual trail because the map indicates that it starts in a river, so I find something that looks close enough but it ends up just being a sidewalk adjacent to a shipyard and I’m not feeling it, so after 20 minutes, I head back towards downtown and walk around a park. After about 30 minutes, I return home and watch Love After Lockup while cleaning. My god, this show is garbage but I love it. I pack my lunch and head to work.

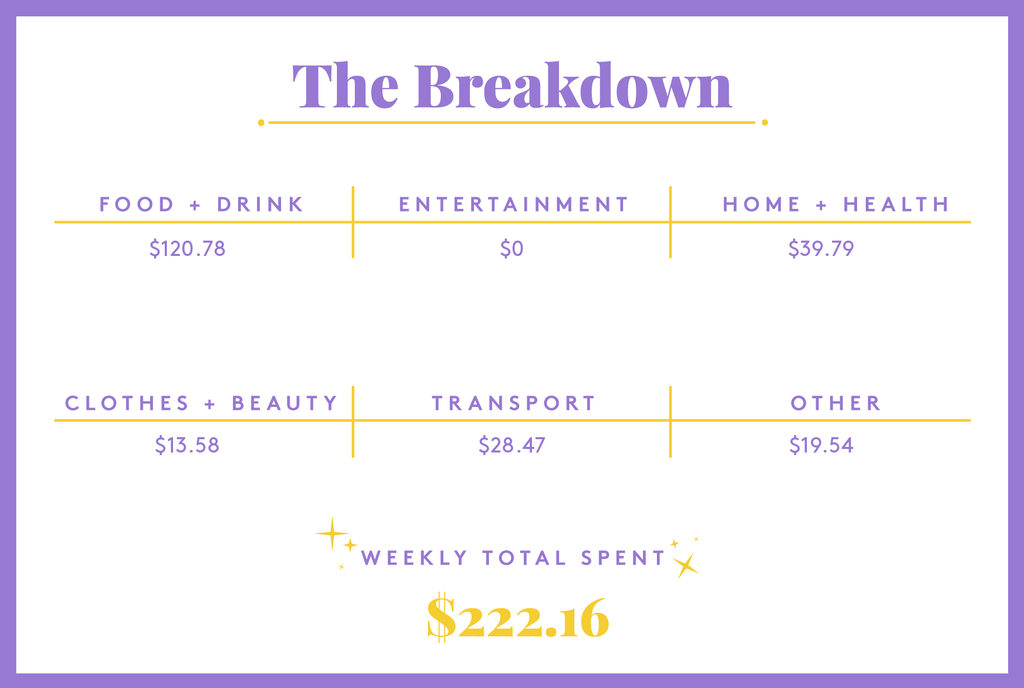

Daily Total: $3.65

Day Two

12 a.m. — I start out my workday, checking email and completing routine tasks. I realize I’m feeling a little weak and heat up the ricotta bake that I brought from home while I go through my emails. I slowly start to feel better as the shift goes on thanks to a combination of distraction and podcasts (currently, The Popcast), as well as organizing a socially distanced outdoor girls night with my girl group.

5 a.m. — I fry up two eggs in the work kitchen, it’s my first time eating eggs since my surgery. I eat the first egg but then my stomach is like, “Nah, bitch” and I can’t finish the second one. I watch My 600 Pound Life and text C. while he suffers through a work function. The irony of watching My 600 Pound Life right after having weight loss surgery isn’t lost on me.

8 a.m. — I leave work feeling nauseated and I’m asleep by 9.

2 p.m. — Ideally I would like to sleep until 4 or 5 p.m. but most days my body is like, “wake up now for no reason” at around 2 or 3 p.m. Not enough sleep! C. calls and we video chat for five hours. Normally, we video chat a lot while I’m doing stuff (running errands, cooking, etc) but lately we’ve been having long conversations about the logistics of me moving there in less than three months, enrolling in school, etc. At around 7, he goes to sleep and I get up and shower.

7:40 p.m. — I stop at Starbucks and get a grande drip coffee ($2.65). I drive to my gym to discover that it’s closed, which is bonkers because it’s supposed to be 24/7. I check online and all the gyms are closed. I drive to a park near my house, and as I’m getting out, I see a bunch of youths shouting and hollering while riding on roller skates. It’s funny but also unsettling because it’s dark so I hop back in my car and drive home. $2.65

9 p.m. — I make some cheesy eggs and chat with my roommate for a couple of hours. I’ve known one of my roommates for a few years on more of a social basis, so getting to know her better is great. I pack my lunch and get ready for work.

Daily Total: $2.65

Day Three

2 a.m. — Work is slow despite trying to find little projects to stay busy. Having a job with a lot of downtime is nice compared to the back-to-back-to-back stress of some jobs I’ve had in my field, but I also get plagued with the “am I doing enough to justify being paid” anxiety. I spend a good portion of my shift applying for FAFSA and getting my transcripts ordered. I’m starting school again, and while the idea of getting back into student debt gives me panic sweats, I really want a career change. Plus I’ll be using some of my “travel savings” and investing it in my career, which will help with the debt fears.

8 a.m. — My workday (work night?) ends and I head home, grateful that it’s my weekend from my “main job.” C. is in a teacher’s union meeting so I go home and fall asleep by 9 a.m.

3 p.m. — I wake up and get ready for my second job. I used to work five days a week at my second job (phone customer service for a major retailer) but now I only work a couple of hours a week. Since COVID, this job has gotten a lot more stressful (way more phone calls, delayed orders, angry customers) but I really like my boss so I stick around despite meeting my savings “goal” back in February. I shower, get dressed, and stop at a coffee cart outside of work where I spend $3 on a drip coffee and $1 on a tip. $4

7 p.m. — Work is going shockingly great. Customers have been easygoing and I have a new coworker who is a lot of fun. I buy two bottles of water with my employee discount because I forgot my water bottle ($2.85) and I order a Qdoba chicken burrito bowl online ($10.49) for pick-up. $13.34

8 p.m. — My friend invites me over to go on a walk so I grab my burrito bowl and head over (I asked if he wanted anything; he didn’t). It’s nice to catch up with friends after isolating for so long. COVID is making me weird.

11 p.m. — I head home and C. calls. I fall asleep around 2 a.m. while watching him cook lunch.

Daily Total: $17.34

Day Four

7 a.m. — I wake up for an eye appointment. I chose my ophthalmologist because my friend works at the clinic and I hope he’s assigned as my tech. I check-in for the appointment and he’s assigned to do my eye exam. We catch up while he does the exam. He invites me over for dinner on Thursday, and I happily say yes. I meet with my new ophthalmologist and oh my gosh, she’s my new favorite person. So kind and bubbly! I leave with a new prescription and the world’s most dilated eyes. I thought there would be a copay, but there isn’t?

9:30 a.m. — I had planned to go fly my drone with my free morning but my eyes are still messed up. I can see far away but up close it’s not happening. So instead I make a turkey roll-up and take a nap, hoping the nap gives my eyes time to get their life together.

1 p.m. — Working nights means I’m tired pretty much all the time, and I often either get way too much sleep or way too little. After my weird morning nap, I putz around the house and eat a little more of the burrito bowl. I check my work email at my main job (which I have paired with my phone) and see an email from HR that says I’m getting a market-adjusted raise of an extra $5.50 an hour. Uhhhhmm, what?! I’m positive this email wasn’t meant for me because that’s just insane considering they told us we would be getting only a 1.2% raise this year due to COVID, not a 22% raise?! I want to jump for joy but if this ends up being a mistake, I don’t want to be disappointed, so I’m cautiously optimistic.

3 p.m. — I change and get ready for my second job. Gotta love a vibrant uniform! I stop by Starbucks and get an iced americano ($3.65) and video chat with C. in the parking lot since I’m early. $3.65

8 p.m. — Another great day at my second job and I’m buzzing! It’s so nice to have a good time at work. I head to the gym and get in 45 minutes of exercise before heading home. I drink a vanilla protein shake on the drive home and listen to Love After Lockup Cray Cray (a podcast). I scramble an egg with cheese. Eventually, I fall asleep around 3 a.m.

Daily Total: $3.65

Day Five

11:30 a.m. — I wake up, check my phone, and shower. I throw together a swiss and turkey roll-up. I grab my drone and head out the door.

12:30 p.m. — I stop by Starbucks and get an iced americano for work tonight and a decaf americano for now ($7.30). I’ve cut down on my caffeine drastically since my surgery, going from 48 ounces of coffee minimum every day, to only 16 ounces of caffeine, maximum. I’m still probably spending too much on coffee but whatever. I also stop by Target because my roommate mentioned needing a keyboard as she’s WFH and I have a gift card, so I decide to surprise her. $7.30

1 p.m. — I drive down the Turnagain Arm, which is adjacent to one of Alaska’s few highways. It’s probably one of the most beautiful places in the world. I stop off a few times to get some drone pictures of the beautiful fall colors. My plan was to go photograph an abandoned building that I know of, but I decide not to and head back to Anchorage. C. and I spend a lot of the drive talking through some ongoing cultural differences and the conversation ends on a good note.

5 p.m. — I stop at the store. I used to hate shopping pre-COVID, but now I absolutely loathe it. My ophthalmologist suggested a few home remedies for my chronic dry eyes including fish oil soft gels, baby shampoo, and preservative-free eye drops. I also get cheese, low-carb milk, mustard, pickles, turkey lunch meat, bagel seasoning, and a generic version of Hint water. I head home, put my groceries away, and eat a yogurt. I take a short nap and get ready for work. $62.76

10 p.m. — I stop by my friends’ house to pick up a package I had delivered to them. We catch up outside for a bit. It’s weird seeing friends for the first time in months because it feels like everyone is frozen in time and so little has changed for everyone. I also have to fight feelings of guilt for doing even the most basic of social things. Many of my interactions have been outside, but it’s Alaska and that’s not going to happen when it’s -20 degrees. I head to work.

Daily Total: $70.06

Day Six

2 a.m. — I’m fighting off a migraine but the shift is going well. I eat two small meals throughout the shift. I check my HR website and speak with some of my coworkers and sure enough, I got a 22% raise! I’m super stoked. I have no idea what my future paychecks are going to even look like at that rate with taxes and everything, so I don’t even try to calculate it.

8 a.m. — I head home, brush my teeth, change into pajamas, put 30 Rock on the iPad, and fall asleep shivering. It’s cold.

3:30 p.m. — I eventually wake up, shower, make an Orgain chocolate protein shake. and throw some cheese sticks in my bag. I pack up my swimming suit, shorts, flip flops, and towel for swimming class later.

5 p.m. — I was supposed to visit my friends and their new baby today, but it’s raining buckets and I don’t want their baby to get all rained on on my account, so I cancel. He reminds me I have an open invite any time I want to come over. I go to Target because it was just my friend’s dog’s 11th birthday and I need to get a toy. I get a bag of riced cauliflower ($2.69), frozen broccoli ($2.35), a thing of lotion ($3.59), a heatable eye mask for my dry eyes ($9.99), an electric throw blanket ($35.49), and a pet toy ($8.54). $62.65

5:40 p.m. — I stop at the Starbucks in Target but I’m running late and there’s a family of 200 kids who are all picky and indecisive. I keep thinking I should just leave but I’ve already waited so long and the pool is close by. I end up leaving too late and decide to skip the swim class and head to the gym. I’d rather not go to something than be late. Being late is the worst, I won’t do it! $3.75

7 p.m. — I finish up at the gym, grab my post-op medication refill at Walgreens ($4.30), and head home where I eat cottage cheese while listening to Crime Junkies. I hide under the heated blanket and eye mask until it’s time to get ready for work. $4.30

Daily Total: $70.70

Day Seven

2 a.m. — I spend some time researching my future school and the degree options offered. I’m getting increasingly excited about returning to school, and even more excited about my career path (computer science). My transcripts cost $11 to email over from my alma mater, which is silly because it’s only an e-mail and also because I already spent $40,000 on the degree but ooookay. $11

4 a.m. — One of my side hustle payments hits and I immediately transfer the amount to savings ($195).

8 a.m. — I head home and get a call from the admissions advisor to go over my degree options. It looks like I might be starting school again in a few weeks! I need to do more research but I’m excited. After, I talk to C. until I fall asleep.

3 p.m. — I wake up, shower, get dressed, eat some cottage cheese and yogurt (separately), and leave for the day. I listen to the podcast Escaping NIXVM, but it bums me out so I switch to Armchair Expert. I’ve never listened to it before but I keep hearing about it so I’m happy to check it out.

4:30 p.m. — I run a few errands before dinner at my friend’s house including getting gas ($28.47), coffee ($3.65), and cider for dinner ($10.99). I don’t drink so I just pick the cider with the nicest label and hope it’s not bad. $43.11

6:45 p.m. — I arrive at my friend’s house. The six of us have dinner on the porch despite how cold it’s getting. It ends up being a fantastic time, everyone loves the cider, and it just feels so amazing to be with people I care about.

10 p.m. — I go home, pack up a lunch (pork tenderloins), and head to work.

Daily Total: $54.11

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Denver, CO, On A $28,000 Salary

A Week In Wisconsin On A $52,000 Salary

A Week In Saudi Arabia On A $22,400 Salary

DMTBeautySpot

via https://www.DMTBeautySpot.com

Refinery29, Khareem Sudlow

0 comments