Why Are Some People So Upset About Canceling Student Debt?

November 17, 2020BruceDayne#DMTBeautySpot #beauty

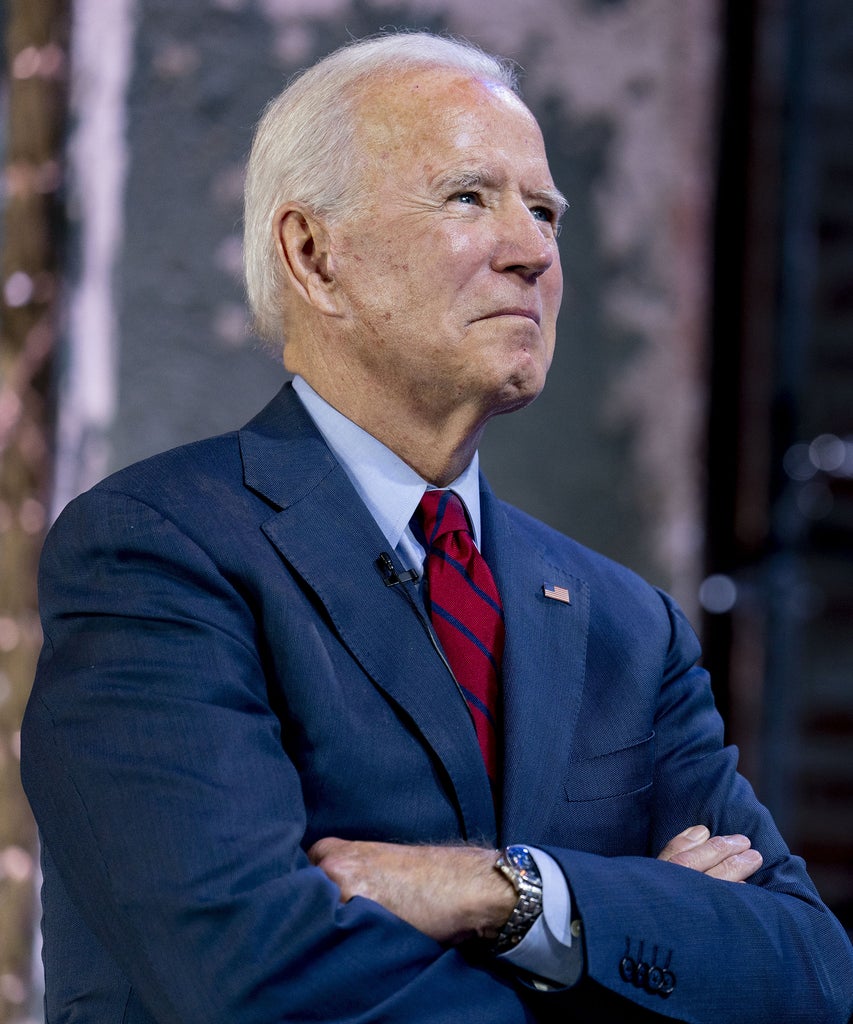

President-Elect Joe Biden will not take office until January 20th, but people are already discussing what will and won’t change once he’s sworn in. One possible agenda item for Biden’s first day involves the student loan debt crisis. With student loan debt currently standing at over $1.7 trillion nationally, it’s no wonder that Biden and his team have been discussing ways to ease the burden of student debt. During a recent interview, Senate Minority Leader Chuck Schumer suggested that Biden could cancel up to $50,000 of student loan debt per borrower — and do it very quickly, through an executive order.

But rather than sparking unanimous joy, the notion that countless Americans could suddenly be relieved of crippling debt was controversial, and #CancelStudentDebt began trending on Twitter. Not everyone was thrilled with the idea that people who currently have student debt wouldn’t have to pay all of it.

I think Dems are wildly underestimating the intensity of anger college loan cancelation is going to provoke. Those with college debt will be thrilled, of course. But lots and lots of people who didn’t go to college or who worked to pay off their debts? Gonna be bad. https://t.co/SCxdIekT0P

— Damon Linker (@DamonLinker) November 16, 2020

Those opposed to canceling student debt claim that doing so would create resentment in people who spent a long time paying off their own college debt, who might have prioritized jobs that pay well over jobs they’d enjoy, or delayed milestones like home ownership, marriage, or having a child because of their debt. They had to sacrifice and suffer, and it rankles them that current and future college grads might not have to sacrifice and suffer in the same way.

Something those people should keep in mind, though, is that their experience of massive student loan debt is not one shared by every generation of students. From 1988 to 2018, the cost of college increased by 213%. Wages, unsurprisingly, did not increase by 213% in that period — in fact, they’ve pretty much remained stagnant since the 1970s. In 2019, for the first time ever, the average amount of debt that students who borrowed money graduated with was over $30,000. In addition, currently about 11% of student loans are in default or are over 90 days delinquent. While federal student loan interest rates are currently set to 0% because of the pandemic, this expires after December 31st, 2020 unless Congress extends it, and expected interest rates aren’t exactly low. For federal undergraduate loans disbursed between July 1st 2019 and June 30th 2020, the interest rate is 4.53%. For federal graduate or professional school loans taken out during this period, it’s 6.08%. If someone leaves school with $30,000 of debt, the typical repayment plan would have them making their last payment 20 years later. And even if a person literally can’t pay them off, student loans are also extremely hard to discharge in a bankruptcy filing; the public service loan forgiveness program is extremely difficult to get into. It’s far more likely someone would lose their house then lose their student loan responsibilities. It’s no wonder carrying student loan debt is also a huge psychological burden.

So, with all the emotional weight attached to this type of debt, and if you spent 20-plus years never dining out or working 24/7 in hopes of getting a much-needed raise to chip away at your outstanding student loans, perhaps it makes some sense that you think that everyone else who went to college have to live the same miserable way as you did. That’s Damon Linker’s logic, anyway, and that of fellow conservatives.

College is a choice. Pay your own bills just like I did! #CancelStudentDebt

— 90s Vol 🧡🐝 (@SEC_CRNA) November 16, 2020

So if the latest plan is to #CancelStudentDebt does that mean those that have already paid off their student debt are given a reimbursement check?

— Nick Short 🇺🇸 (@PoliticalShort) November 16, 2020

But, it’s important to note that a large part of the “anger” Linker tweeted about stems from differing concepts of “fairness.” For some, it means subjecting others to whatever they were subjected to, no matter how difficult and cruel. If you had to walk uphill both ways to get to school back in your day, that should be the price for your children, too. For others, fairness is about opportunity: because you had to walk uphill both ways to get to school, you think it’s only fair to use your experience to advocate for a public bus system for your children. The latter group believes in a society where people are all working toward a future where everyone is on more equal footing, and where those who aren’t wealthy can get a college degree without being saddled with $30,000 or more in debt. Student debt relief is correcting what was unfair from the get-go — education that is so expensive as to be out of reach for many. While some argue that going to college is a choice, it’s undeniable that it feels like a requirement even for entry-level positions in professional industries.

Perhaps most importantly, canceling student debt doesn’t negatively affect those who’ve already paid off their student loans. Insisting that other people pay off their loans in full, no matter how much of a hardship, is demanding suffering for the sake of suffering. By that logic, will those who survived COVID-19 be angry about people who can get vaccinated from it? Talmon Joseph Smith, an editor at The New York Times, explained this visually using the famous Trolley Problem as an example:

— Talmon Joseph Smith (@talmonsmith) November 16, 2020

Another thing to consider is that the benefits for those being forgiven for student debt could be enormous. A study by the National Bureau of Economic Research found that people who’ve had some of their student debt discharged “experience higher income growth and earn higher income by about $3,000 over a three-year period following discharge,” compared to those that haven’t had debt discharged. They were also more likely to move to different areas and change jobs more frequently — having less debt understandably gave them more flexibility and opportunities. The paper notes that “forgiveness leads to a significant improvement in their financial conditions and better labor market outcomes.”

And while critics of student debt cancelation argue that the loss in student loan payments would harm the economy, it’s a loss that could be offset by collecting more taxes from the wealthiest Americans. American billionaires added over $600 billion to their wealth this year. Globally, the 500 richest people have become $1.2 trillion richer during 2020. Instead of making millions of Americans who just wanted to go to college, get a good job, and afford the kind of life that their parents were able to, feel trapped for decades by mountains of debt, we have the chance to relieve their burden and see how they can thrive. Suffering, after all, does not make anyone stronger, it just makes them hurt. Why not prevent that if we can? Suffering isn’t a virtue; preventing other people’s suffering is.

Like what you see? How about some more R29 goodness, right here?

Real People On Having Student Debt During COVID-19

Do I Pay Student Loans Or Save For An Emergency?

Where Is Student Loan Debt The Lowest? 2020 Report

DMTBeautySpot

via https://www.DMTBeautySpot.com

Whizy Kim, Khareem Sudlow

0 comments