Welcome to Money Diaries, where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

This week, a managing director working in banking/investments who makes $280,000 per year and spends some of it on tiramisu.

Occupation: Managing Director

Industry: Banking/Investments

Age: 35

Location: Manhattan, NY

Salary: $280,000 + discretionary bonus (varies greatly — last year was $60,000)

Net Worth: About $700,000 ($250,000 in retirement accounts, $150,000 in real estate investments, $250,000 in managed portfolios, about $10,000 in crypto, and the rest in checking/savings accounts; I am actively looking for more investment opportunities.)

Debt: $0 (I pay down my credit card bills in full every month.)

Paycheck Amount (1x/month): $14,200

Pronouns: She/her

Monthly Expenses

Rent: $3,862.50 (I live in a nice one-bedroom in a full-service building with great amenities.)

Loan Payments: $0

ClassPass: $20 for 10 credits

Cell Phone: $75

Internet: $55

Electricity: $50-$80 (usually higher in summer because of AC)

Netflix: $8 (A friend and I split the four-screen option. We each have one other person mooching off us.)

HBO Max: $99 annually (A few friends use mine.)

Hulu: $0 (I use a friend’s account.)

Amazon Prime: $119 annually

Apple iCloud: $0.99

Private Health Insurance: $1,045, for which the company pays half, so my share is $522. I know this sounds expensive, but I have no deductibles and no copay for anything including all medication, mental health sessions, and physical therapy.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, absolutely. I don’t think I was even aware that not going to college would be an option. Not only that, but I knew my only choices were “useful subjects” to study, meaning things like history and drama were absolutely out of the question. I chose law, which was just on the border of being acceptable (medicine would have been more desirable). I got both my undergrad and graduate degrees in the U.K., and being an E.U. citizen, it was a little over £1,000 (currently $1,341.55) per year for undergrad at the time, and just over £10,000 ($13,415.55) for my graduate school. Parents paid for everything, along with living costs, some of which were reimbursed by their work.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t have any conversations about money at all. I know we were comfortable but not rich, not compared to some of my friends who went to the same private school where my tuition was again subsidized by my parents’ company. My parents firmly believed that money was not a topic suitable for kids, and my only concern in life should be getting good grades in school.

What was your first job, and why did you get it?

My first paying job was as a counselor at a summer camp after my first year of college. I only got this because my boyfriend at the time worked there, and I wanted to spend the summer with him and have a little spending money on the side. I think I was paid €300 per week, which was a lot of money to me at the time.

Did you worry about money growing up?

I didn’t, because I don’t think I truly grasped the concept of money. Yes, I had friends who lived in much bigger houses and bought more stuff, but I don’t ever remember being aware of the difference between ultra-wealthy and middle-class. I never felt deprived, and my parents always bought me whatever I needed. Granted, I also didn’t have extravagant taste or demanded anything outrageous, either.

Do you worry about money now?

Not really. I think I worry more for the long term — like will I have enough to retire? Or if I lose my job, how long would I last? But I don’t really worry day-to-day. Luckily, I can afford my current lifestyle without worrying about having a budget.

At what age did you become financially responsible for yourself, and do you have a financial safety net?

I became financially responsible for myself after graduating with my master’s degree when I was 22. During that last year, my parents still paid for tuition and accommodation, but I was already responsible for all of my daily expenses, which I paid for from the earnings from my summer banking internship and part-time data-entry jobs during the school year. After graduating, I got my first job and never asked for money from my parents again. I know they would be there for me if something drastically goes wrong. I can always move back home, but I really hope to never have to do that.

Do you or have you ever received passive or inherited income? If yes, please explain.

None. I am an only child, so whatever my parents do have will pass down to me, but I have no idea how much that would be, and hopefully, that won’t happen for a long, long, LONG time yet, so I don’t really count that when I think about my financial situation.

Day One

8:30 a.m. — Wake up late because I went to bed late. My ideal morning routine will have to be sidelined. I listen to the news as I make my bed, brush my teeth, wash my face with cold water to wake myself up, and spritz my face with a facial spray. I don’t know if this does anything, but it smells nice.

9 a.m. — Log into work, fill up my water bottle (trying to drink at least a liter, or 34 ounces, a day), take my assortment of vitamins, and start making coffee at home. I bought a small coffee machine during Black Friday, which is easily one of my best purchases. Just the ritual of making coffee — and the smell — wakes me up.

10 a.m. — Log on to a sales call for another side of the business I am not super involved in. It is not mandatory for me to attend, but I like to listen to how the rest of the business is doing. I multitask and field emails at the same time.

12:30 p.m. — I heat up some leftover Indian food from the weekend and listen to a true-crime podcast to relax.

3 p.m. — I log on to a Zoom panel call. I’ve been actively involved in a charity aimed at helping first-generation university students get job-ready. All of our events have been sidelined because of COVID, and we try to host virtual sessions monthly and break out into smaller groups to help students practice Zoom interviews. I really feel bad for them; I don’t know if I’d been able to handle this at their age!

6 p.m. — I go with a friend to a workout class nearby, which I signed up for via ClassPass. We grab dinner afterward at a cute sushi place close by (this has become a really good Monday ritual for us). I, and everyone I hang out with, have been vaccinated and boosted, and I’ve been testing regularly for the past month, but so far I’ve been very lucky. We also mask up whenever/wherever is necessary. $45.32

8 p.m. — Get home and am feeling super full. Mindlessly put on the TV and scroll through my phone. I just ended a long “situationship” a week ago. After two years of us talking every day and becoming each other’s emotional support and best friend during the pandemic, the man still refused to commit, so I finally cut the cord. Everything reminds me of him and I wallow in self-pity for a bit. I am struggling to find a TV show to watch that we haven’t seen/talked about together, so I end up putting on some reruns of Criminal Minds and cry.

12 a.m. — Finally drag myself to bed. This feels like an achievement because I’ve been falling asleep with the TV on as background noise more often than I’d like to admit in the past week. I don’t like being alone with my thoughts in the silence, so I put on a soothing meditation podcast and fall asleep at some point.

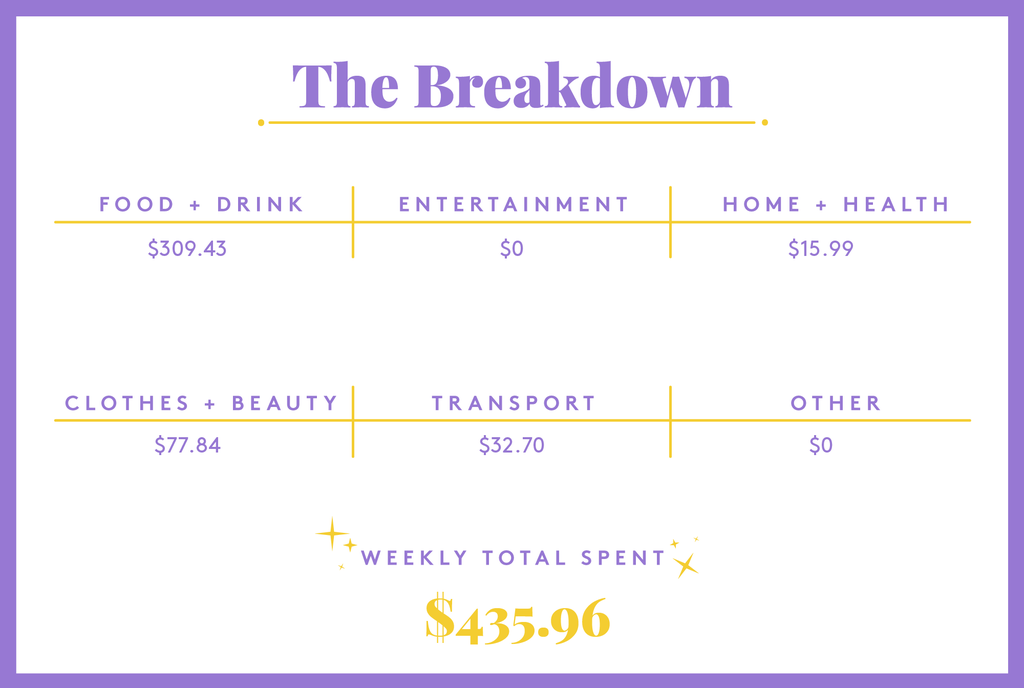

Daily Total: $45.32

Day Two

7:30 a.m. — Miraculously wake up on time, put on a meditation podcast, and promptly fall back asleep. I have not yet been able to meditate successfully, but this is definitely something I want to take more seriously.

8:30 a.m. — Finally out of bed and do the usual morning routine: listening to news while brushing my teeth and washing my face. I put on some vitamin C oil and a moisturizer with SPF. I usually don’t wear makeup and generally am pretty lax about my skincare, but SPF is a must!

9 a.m. — I am running a meeting, so I don’t have time to make coffee. Thankfully, it ends on time, so I run out and grab a skinny vanilla latte at Starbucks. I am a coward and walk a couple more blocks to another Starbucks instead of going to the one I used to go to with my ex. It is freezing out, but at least the fresh air feels good. $5.39

12:30 p.m. — I got a coupon for the new year for MealPal, so I signed back up for the month. I’ll cancel once the discount runs out. I opt for a Sweetgreen salad today; with the credits, it works out to about $6.35 instead of the usual $14+. $6.35

3 p.m. — I do a networking call online through a club. I used to attend a lot of networking events pre-pandemic. I am trying to be active online, but it’s really not the same. The idea is that they blindly pair you up with another member, hoping you’ll make an interesting/useful connection. However, most of my matches happen to be founders looking for funding, or coaches/mentors/entrepreneurs/whatever-they-call-themselves looking to “help” someone grow in their life both professionally and personally. I get another life coach today — not super interesting to me.

7:15 p.m. — I attend a free spin class at my local spin studio. It is for a new teacher, so they are trying to drum up some interest for him. Good workout, but he was super chatty and had a lot of “choreography,” which made me feel like I was falling off the bike half the time. Still worked up a good sweat, though!

8:30 p.m. — Quickly rinse off and meet up with a friend for dinner nearby. The restaurant is really empty, a combination of the cold weather and COVID. We share a couple of appetizers, one entrée, and one dessert. I also get a glass of red wine. It feels decadent to drink on a Tuesday. $74.19

11 p.m. — Home, showered, cozy PJs, and fuzzy socks on. I got a three-month free trial to Peacock because I’ve heard such good things about Yellowstone. Episode one is so long, though! I fall asleep at some point and drag myself to bed at 2 a.m.

Daily Total: $85.93

Day Three

7:30 a.m. — Wake up, same morning routine. I hastily read over some materials to prep for our investment call later.

9 a.m. — We have our monthly investment committee meeting. These are usually very informative, but can drag on. When we were in the office, I used to look forward to these, as we’d get a great catered breakfast spread, but today I make do with coffee from home.

1 p.m. — The morning flies by, as we have to update a number of things based on the investment meeting, with a lot of emails back and forth with our investment teams and both internal and external managers. I break for lunch with a friend. We take advantage of a great place in Midtown with an affordable lunch menu. I catch her up on my breakup, and to her credit, she doesn’t tell me “I told you so,” which I totally would have deserved. I can’t talk about it without crying, so we switch gears and strategize on how she can find a new job instead. The market is super hot right now. I promise to put her in touch with a couple of recruiters I know. $17.50

3 p.m. — I spend most of the afternoon drafting up various pertinent points to email out to our UHNW (or ultra-high net worth) clients. Someone from my team will polish up the emails and send to compliance for approval before they can be sent out.

7 p.m. — I take the subway uptown to a friend’s place for dinner ($2.75). We have delicious homemade lasagna and the tiramisu I pick up from Eataly ($15.90). She is stressed about having to move because she got a great COVID deal and now the rent has gone up so much. I know I will be facing the same in the summer, which gives me some anxiety. We end up having a glass of wine and watching some old episodes of 30 Rock. $18.65

10:30 p.m. — Get home by subway ($2.75) and am super full. Resist the urge to veg out on the couch. Instead, I brush my teeth, wash my face with a mild cleanser, put on toner and moisturizer, and get into bed. This is as much of a nighttime skincare routine as I’ve got going on at the moment. $2.75

11:30 p.m. — I alternate between reading a book (Empire of Pain, about the Sackler family and Purdue Pharma) and writing down random things I have to do tomorrow on my phone. Finally, it’s lights out around 12:30 a.m.

Daily Total: $38.90

Day Four

7:30 a.m. — Wake up, same morning routine, and remember to put in an order for biotin as I just ran out. $15.99

10 a.m. — A fund manager we work with is hosting a webinar on the outlook of 2022. I tune in, but also multitask by working on a pitch we have to present to a big prospective client. Send it off to marketing to flesh it out properly.

11:30 a.m. — I run a few 10-minute individual check-ins with various members of my team. Since we haven’t been in the office for so long, it becomes even more crucial to do a “non-agenda” check-in on a regular basis. Everyone is doing well, which is great to hear!

1 p.m. — I pick up Thai food from a truck nearby using my MealPal credit. $4.76

3 p.m. — I booked a trial Spanish class with a teacher online. I took it in high school and have always loved the language. This is one of the things I decided to pick back up in 2022. The trial class is free and I really like the teacher, so I will be doing an hour per week with her. We agree on a time, and it will be $25 per class, starting next week.

5 p.m. — My concentration starts slipping as I get an email informing me that something from Amazon is being delivered to my ex’s house. He shared my account and I regularly ordered stuff for him. I wonder if it is too late to cancel, and then reflect on whether that is too petty of me? I end up not canceling, but it’s affected my mood more than I thought, so I have another good cry session. Surely, I should be cried out at this point?

6 p.m. — Talk to a couple of friends on the phone — they are the best. I snack while I talk — some carrots with hummus, seaweed snacks, chocolate pretzels, and cereal.

9 p.m. — I drag my sorry ass to the gym. I do a 30-minute run on the treadmill, followed by 10 minutes of abs and 10 minutes of stretching. I’m not miraculously transformed from working out once, but I do feel somewhat accomplished.

11:30 p.m. — Showered and in bed, listening to some random celebrity gossip podcasts, the kind of mindless drivel that effectively puts me to sleep.

Daily Total: $20.75

Day Five

8 a.m. — Wake up and luxuriate in the feeling that it is finally Friday. I don’t have any meetings today, so it’s a slower start in general. I listen to a few podcasts as I work.

11 a.m. — Not having a real dinner means I am hungry earlier than usual. I toast some bread, make a sandwich with some turkey slices, cucumber, and tomatoes. I have it with the French onion soup from Trader Joe’s.

1:30 p.m. — I have my therapy session online. I used to see my therapist in person, but everything is online now, of course. She’s been very supportive in helping me navigate my emotional mess, but there’s really nothing to it but time. I know it was the right decision, but it just sucks. It also doesn’t help that he reached out and tried to start conversations as if nothing happened. He texted me to say he missed me as we were best friends, he even suggested to “scale back” from talking multiple times a day, to at least weekly. I just can’t. Like my therapist said, I need to take care of myself first, and that means not having any contact with him. Session is free with my insurance.

3:30 p.m. — Taking advantage of a slow day, I impulsively decide to go visit my friend who owns a beauty salon. I buy us coffees and a lemon tart to share. $16.85

4 p.m. — The place isn’t too crowded, and we catch up as she does some experimental designs on my nails. She never charges me, but I put in $20 to the general tip jar they have. I wish I had more, but that’s all the cash I have on me. $20

7 p.m. — Get home and finish up loose ends for the week. We start our self-assessment/goal setting next week, which I am dreading, but that is a future problem that I don’t have to deal with just yet. I get ready to head to my friend’s place in Brooklyn. $2.75

8 p.m. — I get two bottles of wine and they get Thai food for us to share. We catch up, play some board games, plan trips that are basically still fantasies at this point, and generally have a great time. $30.12

1 a.m. — I call myself an Uber home ($22.45 + $2 tip) and pass out. $24.45

Daily Total: $94.17

Day Six

9 a.m. — It is FREEZING out. I stay cocooned in my blanket for an hour or so, mindlessly scrolling the internet and texting various friends.

10:30 a.m. — Finally up and get myself ready to run some errands. I go pick up a book from the library, go to TJ Maxx to get a new coffee mug, as I broke one a few weeks back, and grab two sweaters that look cute. I will probably return at least one, if not both. I want to walk around a bit more, but it’s so cold, so I head home. $57.84

11:30 a.m. — Go to my building gym for a quick workout — a dumbbell-based strength routine from YouTube. I place an order for some Chinese food as I start my stretching routine. $28.94

1 p.m. — Showered and munching on food. It’s not as delicious as I thought it would be. I put more than half of it away, as I have an early dinner and don’t want to spoil my appetite.

6 p.m. — I don’t know where the afternoon went. I read for a bit, tidied up, cried a little, which led me into a nap. My friend comes to pick me up, and we head down to Chinatown for AYCE hot pot. I’m so glad he has a car. I probably wouldn’t have left the house otherwise.

8 p.m. — We have to wait for over an hour for a table, but it’s so worth it. It’s the perfect meal in this cold and we leave feeling very satisfied. My friend talks about leaving NYC for good. He’s been traveling quite a bit during COVID and I think he’s actually going to make the move and become a permanent nomad. Super happy for him, but I also know that no matter how much I dream of that lifestyle, I will end up missing the comfort of a place I can call home. $54

10 p.m. — I get into bed early but can’t sleep. When it’s late and quiet, I find myself dwelling on my ex and the past and what I could have done — very unhelpful. I put on a podcast and finally drift off.

Daily Total: $140.78

Day Seven

9 a.m. — Another cold day, but at least it is sunnier. I FaceTime my parents. They live abroad, so we try to catch each other on the weekends. I miss them a lot since I haven’t been able to visit for more than two years now.

11 a.m. — I text with a friend who lives upstate. I was supposed to head up to her today and stay overnight, but the weather forecast is not great and I am worried the train service may be impacted. Decide to take a raincheck and plan for another weekend instead.

1 p.m. — Since my plans got derailed, I really don’t have anything to do today. It is not great to be idle, though. I tidy up a little around the house and sit down to hone in on some positive habits I want to develop this year. Writing things down has always calmed me. I also heat up the second of my Trader Joe’s French onion soups and have it with some toast.

4 p.m. — I meet up with a friend at a nearby café. I get a matcha latte and a hazelnut pastry. It’s our mutual friend’s birthday soon and we want to do something together, so we brainstorm some fun ideas. $10.11

6 p.m. — Try to watch another episode of Yellowstone, but I’m just not into it yet. I’m also not super hungry, as I wasn’t very active at all today and the pastry was quite filling. I snack on some popcorn and chocolate.

9 p.m. — Look at my calendar for next week and plan out my days, including my workouts. They don’t always get done, but having it on the calendar makes me want to be more accountable to myself. I toy with the idea of asking some friends to become accountability buddies.

11 p.m. — Lights out at a decent time! It’s so hard for me to go to bed early on a Sunday night, but it does affect my Monday mornings if I am not well-rested, so I am really trying to do better. Another positive habit I hope to establish!

Daily Total: $10.11

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Brooklyn, NY, On A $27,000 Salary

A Week In San Francisco, CA, On A $200,000 Salary

A Week In Charleston, SC, On Unemployment

DMTBeautySpot

via https://dmtbeautyspot.com

Refinery29, DMT.NEWS, DMT BeautySpot,

0 comments