#DMTBeautySpot #beauty

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

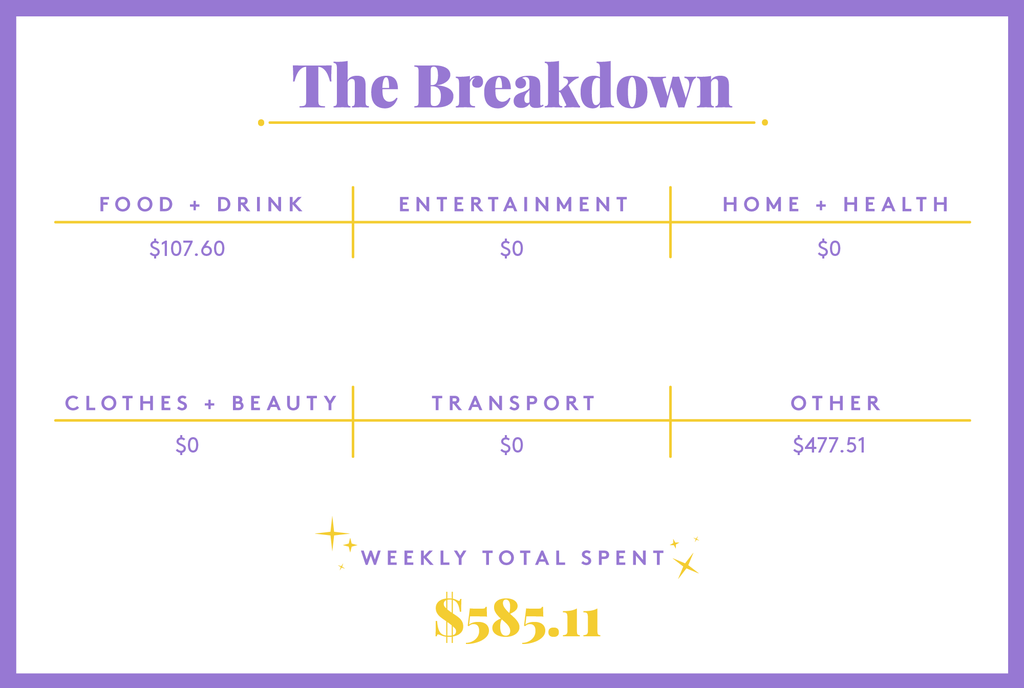

Today: a communications associate who makes $70,000 per year and spends some of her money this week on cat toys.

Occupation: Communications Associate

Industry: Higher Ed

Age: 27

Location: New York, NY

Salary: $70,000 (full-time salary) + $2,500-$4,000 (side gig)

Net Worth: $149,459 ($151,200 assets – $1,741 debt — retirement accounts: $64,600 ($10,800 in Roth IRA; $30,400 in 403b; $23,400 in 401(a)), taxable investments: $60,900 ($58,700 brokerage; $2,200 individual stock), cash: $25,500 ($11,000 in e-fund – roughly six months of expenses; $13,000 in sinking funds which is high partly due to reduced spending during the pandemic with no pause in savings; remainder in checking accounts, HSA: $200 (opened this year).) My partner and I split our joint expenses equitably based on income. This equates to a roughly 40:60 split, me:him. We do not have any shared accounts or cards. Our spending money is our own but we have similar financial habits and goals and tend to discuss any large (>$100) purchases.

Debt: $1,741 outstanding balance on Peloton, financed at 0% APR with ~2 years remaining

Paycheck Amount (bi-monthly): $1,437

Pronouns: She/her

Monthly Expenses

Monthly Housing Costs: $775 (my share of a one-bedroom split with my partner, F.)

Peloton Loan Payment: $64.32

Health, Dental, Vision Insurance: $32 (pre-tax)

HSA: $50 (pre-tax)

Transit Benefit: $5 (pre-tax)

403(b): $812 (pre-tax)

Cell Phone: $40

Peloton Membership: $39

Vitamins: $90

Spotify: $9.99

Streaming Services: bartered access with friends + family for access to our Netflix which F. pays for.

Charity: $80

Savings: $1,200+ ($255 to sinking funds + remainder to Roth IRA until I max that account, then it will go to my brokerage.)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

It was an unspoken understanding between me and my mom. I liked school and did well, and college was something that I wanted for myself. I attended a top-ranked private four-year university that offered a significant financial aid package. My education was financed through university-awarded merit scholarship, financial aid assistance (including federal Pell grant), loans, outside scholarships (usually <$2,000/year), multiple jobs (~30 hours/week by the time I was a senior), and some help from a generous family member. That family member paid about $25,000 across my four years of school. I graduated with $20,000 in debt that I paid off about one and a half years after graduating with some help (see Passive Income section).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I wouldn’t exactly call them conversations. It was more, “we can’t afford that,” and “it’s too expensive.” Any financial literacy I have comes from personal interest in the topic and lots of research and reading. My mom doesn’t even have a credit card.

What was your first job and why did you get it?

My first time being paid was probably babysitting around age 13. My first W2 job was as a lifeguard at age 15. It was the thing to become once you were old enough. My best friends were also lifeguards and it gave me some spending money so I wouldn’t have to ask my mom. I saved about a quarter of what I earned each summer.

Did you worry about money growing up?

I didn’t always. During my younger years, my family was well-off. Then my dad lost his job, and unknown to my mom and family, he kept us afloat via credit cards. We foreclosed on our house, moved into a rental, and then my dad died unexpectedly. Also, unexpectedly, he left my family in ~$100,000 of credit card debt, some of which was tied to my mom’s name. Her credit was demolished. My mom was a stay-at-home mom and suddenly had to re-enter the workforce after 15 years of not working. We moved again, this time into a not-so-well-maintained apartment, and money was a constant issue. We were able to get about two-thirds of the debt dismissed because the cards weren’t attached to my mom’s name. My extended family cobbled together the money to pay off the remaining amount. Still, my mom was barely earning enough to make ends meet for my family. She was very open about our financial situation, perhaps too open at times, and I had a lot of money anxiety. I knew how tight money was but had limited agency of a child and thus no way to really change things. It’s taken a lot to move past that anxiety.

Do you worry about money now?

For myself, not really. I do worry about my mom’s retirement. She hasn’t been in the workforce for very long and in the early years when she was still paying for me and my sibling, she didn’t make enough to contribute very much to retirement. Sometime this year, I’d like to sit down with her and discuss how much she has saved and how much she needs per month so that I can start planning to help her. I want this to be an in-person, face-to-face conversation, though, so it’s COVID-dependent. I’d also like to do some investigating about whether she would qualify for widow’s benefits when she retires but I want her permission to do so.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I would say when I was 18 and in my second year of college because I was paying for all my living expenses and most of my education, but technically, part of my tuition was paid for by my relative. I was definitely on my own when I graduated at 21. I have an emergency fund that would cover six months of my expenses. I live with my partner (who also has an emergency fund) and either one of us could afford to take on the bills solo if the other lost employment. We both have family that could take us in if shit really hit the fan.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received survivor’s benefits for almost a decade through the Social Security Administration. I don’t know how much this amounted to and I don’t care to know. It all went to my mom and was used for exciting things like rent and food. As mentioned in the higher education section, a relative contributed money to my tuition (~$25,000). After my dad died, a lot of people in my town donated to an education fund. I grew up in a relatively small but extremely affluent county, among some families who were very wealthy. My father was very involved in the community and the community was incredibly kind to my family when he died. After a decade of interest and growth, I had about $10,000 to put towards my student loans. I wouldn’t be where I am today without these sources of financial help.

Day One

8:05 a.m. — I’m up. My partner, F., is already awake and reading on his phone. Eventually, we both get up — he goes to make coffee and start work while I go through my morning skin routine and then make the bed. I settle into my desk (i.e. one end of my dining table) with my coffee and look through my Slack messages. I open my browser and look over the products in my Chewy cart because I’m adopting a cat!!! I’m so excited!!

9:45 a.m. — I update language on a client’s webpage and message a colleague to discuss. Then I make my usual breakfast shake (banana, frozen strawberries, cocoa powder, peanut butter powder, and chocolate protein powder). After a while, I feel like standing so I adjust my desk (read: pile boxes and books under my laptop and keyboard and raise my monitor). My company offered a whopping $0 for the work-from-home transition. With my boss’ approval, I borrowed a monitor from the office because my tiny 13-inch laptop makes it hard to do design and web work.

1:10 p.m. — I break for lunch and have leftover Thai-curried quinoa salad with mixed greens. We’re low on mixed greens, so I bulk it up with some roasted chickpeas, cauliflower, and red onion that I prepped over the weekend. I plop on the couch to finish an episode of Criminal Minds while I eat. I finish updating the content from earlier and then move to a different part of the website to add some additional content. The sun is finally shining so I go for a walk. **For brevity, I do not mention putting on a mask or washing my hands whenever I leave or return home, but I take COVID precautions seriously.**

3 p.m. — Get back home and I make an iced chai with vanilla soy milk and Oregon Chai Mix. I update some project files to prepare for a client meeting, update an online form, and then get started on some design work.

5:30 p.m. — Finish the design work and decide to sign off for the day. I stay at my desk to pull the trigger on the Chewy order. I buy toys, a bed, litter and accessories, a drinking fountain, a carrier bag, scratcher toys/posts (including one that looks like a sardine tin, it’s too cute!), and a grooming kit for $390.41. I’m a strategic credit card user and rotate through my cards based on deals and where I’m shopping. This purchase is made with my Citi Double card and will earn 2% cashback. I have a dedicated “cat fund” to pay for start-up pet ownership costs so this expense will not impact my monthly spending and savings goals. I check on the red beans and rice that I started earlier in the day and make cornbread muffins and roasted broccoli. F. and I eat, hang on the couch, and chat about our day. $390.41

8 p.m. — F. cleans the kitchen while I work on a jigsaw puzzle. I highly recommend the New Yorker series by The New York Puzzle Company. Right now, I’m working on a puzzle of the cover of a 1961 winter issue with a drawing of ice skaters in a snowy Central Park.

10 p.m. — I get ready for bed. I’m out of facial oil and winter has sucked all the moisture out of my already parched skin, but I overspent in another category this month so I’m holding off until next month to make the purchase. In bed around 10:30.

Daily Total: $390.41

Day Two

8:00 a.m. — Wake up, scroll through my phone, get ready for the day.

9:10 a.m. — I make some iced coffee, settle into my desk and check my email — nothing new since last night. I’m an avid budgeter and Excel nerd so, of course, I’ve decided that I want to track all my pet-related expenses. As last night’s Chewy purchase is not being paid for by my monthly paychecks (because as I mentioned before, I had dedicated funds set aside for the start-up costs), I create a new tab in my budget and will use a formula to pull in expenses like food and litter that will occur in future months so I can get a sense for my yearly pet costs.

10 a.m. — Weekly meeting with my team where we share updates on projects. Then I make my usual breakfast shake and message with a colleague about how to use a specific function of our CMS. Then I get started on some design work.

1:15 p.m. — Design work is done so I break for lunch: veggie burger on a toasted English muffin with a fried egg and a side of roasted chickpeas and veggies. I watch some Criminal Minds while I nom.

3:15 p.m. — Client status meeting to go over projects and other communications.

3:15 p.m. — Tutoring lesson. Pre-pandemic I babysat as a side hustle; now I Zoom tutor. When the lesson is done, I record the time and head back to work to review some mass emails scheduled for today and later this week.

5:15 p.m. — I sign off for the day and decide to take a walk. While I’m out, I pick some things I missed from last week’s grocery shop (I swear there was tofu in the freezer!). I went with the intention of just getting one container of tofu and some broccoli because I’m already over my grocery budget, but I’m a sucker for a buy one get one free so I end up with English muffins, broccoli, and tofu. I use my Discover card because it offers 5% cashback on groceries this quarter. I usually earn the full amount ($75) in cashback because I buy all the groceries for the household. $13.47

6 p.m. — I get back and start a workout. I used to lift a lot before COVID back when I belonged to a bougie gym. It’s obviously not the same at home — not just the lack of equipment but also, it’s hard to get in the right mindset. I do take solace in not forking over all that $$$ for a gym membership. I roast some more broccoli to go with the leftover red beans and rice. When dinner is ready, F. and I watch How I Met Your Mother while we eat. After a few episodes, he has to hop back on his laptop for work so I offer to wash up and turn on Criminal Minds to keep me company.

9:30 p.m. — I do my skincare routine and lament the cosmic injustice of having both fine lines AND acne. I get in bed and open my book, The Alienist, by Caleb Carr. I decided to re-read it after watching the HBO show and feeling like they changed a lot of things…. my memory was right, they did change a lot of things, and not for the better! Lights out at 11:45.

Daily Total: $13.47

Day Three

7:30 a.m. — F. wakes me up after his early morning call. A personal wake-up is infinitely better than an alarm clock! I do my skincare routine and head out for a walk.

8:45 a.m. — The wind is treacherous, so I cut my walk a bit short. When I get home, F. and I make the bed and then I whip up some dalgona coffee. It was a TikTok/Insta trend at the very beginning of lockdown (less than 12 months ago for NYC but truly feels like 800 months ago) and it has become a favorite in this household. It’s fancy and beautiful and curtails my nostalgia for coffee shop drinks. Then I settle into my desk, check emails, and begin working on action items following yesterday’s client call. I get stuck writing an email so I decide to take a break to check on my bank and investment accounts. I am a compulsive account checker.

11 a.m. — It’s like cat Christmas! EIGHT boxes arrive from Chewy. I really want to open them all and relish in the glory but limit myself to opening just one. I open the box that contains the tunnel-shaped bed and it is so cute and soft and I can’t wait for a kitty to sit inside!! Alas, I return to work so I can make more money so I can buy kitty more stuff. It’s a vicious cycle. At some point, I realize I’m hungry and haven’t eaten anything, so I make soft boiled eggs to go on toasted English muffins with a side of roasted veggies.

2 p.m. — I’m supposed to be on a call but the other person is a no-show. When it becomes clear he isn’t dialing in, I email him to reschedule.

3 p.m. — Tutoring lesson, then return to work.

5 p.m. — Team social hour. I’m lucky to work with a really great group of smart, funny people who are as pleasant to hang with as they are to work with.

6:30 p.m. — I really should make dinner but I just don’t feel like it so instead I finish opening the boxes from Chewy. I attempt to assemble the cat bed but it turns out you need the grip strength of the Hulk to get the screws in place. I’m annoyed that I need to use a drill (instructions say power tools not recommended) but that does the job. F. and I eat leftover red beans and rice (again) and watch How I Met Your Mother (again). He washes the dishes from today and I struggle to stay awake. I get ready for bed, move to the bedroom, and fall asleep watching Criminal Minds.

Daily Total: $0

Day Four

7:45 a.m. — Wake up, get ready, and make the bed with F. He lets me have the leftover coffee in the fridge so I can make iced coffee and he brews a new pot.

8:45 a.m. — I settle into my desk and check my bank accounts because it’s payday! I send $1,500 to my Roth IRA and update my budget. I was over budget in some places this month but managed to keep my Roth IRA contribution high because I received a bank opening bonus (I churn bank accounts for bonuses). Then I get to work scrubbing our e-newsletter audience and scheduling the email for next week.

10:15 a.m. — I make my usual breakfast shake and then get started on an assignment for a workshop I’m participating in. Today is pretty slow and I’m really struggling with motivation so I make a list of the things that absolutely must get done today and tell myself that when they’re done (and my meetings are over), I can sign off. If I commit, that potentially means ending my day at 3. I’ll monitor my email via my work phone after I sign off, but my boss is generally supportive of leaving a little early.

1:15 p.m. — I cross three things off my must-do-today list so I take a break to meal plan. This is a typical Friday habit; I meal plan on Friday, shop on Saturday, meal prep on Sunday. I really don’t like to grocery shop without a list (how do you know what to buy if you don’t know what you’re going to eat??) so meal planning happens every week. Then I finish off the Thai-curried quinoa salad and roasted chickpeas and veggies for lunch.

2 p.m. — I participate in a cross-department workshop. Then I run through a rough draft of a video and compile my feedback.

3:30 p.m. — Done with work! I head out for a walk, get back and check my email, then hop on my Peloton. I decided to mix things up a bit and take a rock class instead of a 2000s-themed one. I guess change is good because I broke my 30-minute PR! *Finger guns* pew pew pew.

7 p.m. — I get started on dinner: baked tofu sandwich with ginger-peanut butter spread. We watch WandaVision while we eat and then I make cocktails (whiskey-amaretto sour with moonshine-soaked cherries). In bed around midnight.

Daily Total: $0

Day Five

8:30 a.m. — I wake up, do my morning skin routine, and start working on my puzzle. F. cleans up the kitchen from last night’s dinner and I make myself breakfast: toasted English muffin with veggie sausages.

12 p.m. — Back-to-back tutoring lessons.

2 p.m. — Finish tutoring and join F. on the couch. He’s been working since I started the tutoring sessions but tells me he took a break to refill our weed gummy stash: five packs (500mg total/bag) of gummies for $100. F. paid. I eat leftovers and head to the store to pick up groceries: bananas, yellow onion, red onion, garlic, pineapple, avocados, lemon, limes, Portobello mushroom caps, tomato, jalapeno, serrano pepper, red pepper, broccoli, cilantro, mixed greens, cauliflower, pears, chickpeas, tortillas, skirt steak, pasta, pasta sauce, soy milk, almond milk, frozen strawberries, tofu, jam, Greek yogurt, eggs, Mexican shredded cheese, gummy cherries, and some loose can sodas and seltzers. $94.13

6:30 p.m. — I start prep for our annual Tacos, Taxes, and Tequila tradition. We’ve found that taxes suck less when paired with tacos and margaritas, and who doesn’t appreciate some good alliteration? We start our taxes and break for strawberry margaritas once we’re about halfway through our federal returns. I pay TurboTax $87.10 to file my tax returns and expect federal and state refunds of $814 and $215, respectively. I’ll probably spend about $100 of my tax refund (I’m thinking of new leggings from the Girlfriend Collective) and use the rest to max out my Roth IRA. We finish making and eating the tacos, split a gummy, make some popcorn, and fall asleep on the couch watching How I Met Your Mother. PSA: if your AGI is under the IRS-set threshold, you can file for free. I should have done more research before starting my taxes because I had major technical difficulties when I tried to use one of the free versions and just didn’t have the patience (I wanted my taco!!) to figure it out. Yes, I’m aware that I basically paid a $90 convenience fee. $87.10

Daily Total: $184.23

Day Six

9:30 a.m. — I wake up and finish my puzzle! F. washes the dishes from last night and makes us an omelet and toast. We decide to turn the Chewy boxes into a cardboard castle fort for our future cat. It’s hilarious and adorable, with multiple levels, a bridge, and a perch. I dig some old blankets out of a closet and use them to cozy up a few of the fort’s hidey-holes.

2:30 p.m. — We fridge forage for something to eat that doesn’t require much work and settle on random leftovers. I prep my lunches for the week: yellow coconut curry with cauliflower and crispy tofu. While my curry cooks, I also make vegetable broth. I save scraps from onions, mushrooms, celery, carrots, and some herbs in the freezer. The process takes about 90 minutes and I end up with 10-12 cups of broth. This helps offset my cooking costs a teensy bit (I make a ton of soups and stews, especially in the winter) and makes me feel good about reducing waste.

5 p.m. — We get a text from F.’s mom that a package was delivered to us, and it’s another puzzle! This one is from the Harry Potter collection, my other favorite series from The New York Puzzle Company. Apparently, I’ve rekindled F.’s family’s love for puzzles and they’ve all been on a puzzle kick since Christmas. F. and I decide to order takeout from a new restaurant in our neighborhood. We each order half a chicken with two sides and split an order of mac and cheese, a Caesar salad, and a slice of cheesecake. They have a 10% discount for first-time orders. The total is $71.22, F. pays. We have a bunch leftover and can probably get another meal out of this. I watch Criminal Minds while F. plays on his computer. We head to bed around 10:30.

Daily Total: $0

Day Seven

7:45 a.m. — I get up, shower, and then wash dishes from last night’s dinner. Not that we’re planning on moving anytime soon, but we have already agreed that our next apartment absolutely must have a dishwasher. That’s an upgrade we’re ready to pay extra for.

9:15 a.m. — I make some iced coffee and settle into my desk and check my email. Today is going to be slow. I update my budget to reflect purchases made over the weekend. I upload pics of my receipt to some cashback apps (Receipt Hog, Receipt Pal, and Fetch) and then work my way through emails.

1 p.m. — I break for lunch. I eat the remainder of the Caesar salad and some curry. Then I have a call and a tutoring lesson.

3:30 p.m. — I finish drafting talking points for an exec in my department. I send the draft to my boss and another colleague for feedback. This is my first time drafting talking points and it was more fun and challenging than I expected. I wrap up my day with some design work.

5 p.m. — I move to the couch to play some computer video games while F. makes enchiladas. We watch HIMYM and then I clean up the kitchen. I convince F. to put on Criminal Minds and then promptly fall asleep. Eventually, I get up to my skin routine and get in bed around 11.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Queens, NY, On A $220,000 Salary

A Week In San Francisco, CA, On A $104,000 Salary

A Week In Northern New Jersey On A $76,686 Salary

DMTBeautySpot

via https://www.DMTBeautySpot.com

Refinery29, Khareem Sudlow

0 comments